Will D.C. Listen? No.

We pick up today where we’ve left off a thousand times before: Wondering why people ignore the obvious…

If you spend any time on TikTok (and I spend much too much time on TikTok before bed) you might have seen the videos of idiots in places like Yellowstone National Park who approach wild bison for a selfie, or to tease the animal.

You have to be a special kind of stupid to do that, but you’ve got to be an extra-special kind of stupid to do so when plenty of warning signs exist telling you not to be so stupid.

Very often, those encounters end very badly because in the mathematics of life: bison > stupid.

Which brings me to Treasury Secretary Janet Yellen.

Bad transition, I know, because Yellen is neither a bison nor stupid.

But she did offer up yet another warning that no stupid-person-of-importance (i.e., politicians) will pay attention to.

Her warning, told to Bloomberg on the sidelines of a recent meeting in Italy of finance ministers and central bankers from the G7 countries (US, UK, France, Germany, Japan, Italy, and Canada):

We’ve raised the interest-rate forecast. That does make a difference. It makes it somewhat more challenging to keep deficits and interest expense under control.

I’ll clarify two points:

First, the interest-rate forecast is not the interest rates the Federal Reserve imposes on the economy.

Yellen is talking about the interest rates the US government pays on the debt it issues. That interest rate is a function of the bond market, and the yields bond investors demand for the risks they perceive in the investments they make.

So Yellen is saying that Uncle Sam is having to pay higher rates on his debt, and that the Treasury Department’s working assumption is that those rates are going higher—meaning America’s debt-repayment costs are going higher. (Check out yesterday’s dispatch showing that trend is already in play.)

Second, Yellen’s use of the word “somewhat” is what I’ll call a linguistic fabric-softener.

Bureaucrats have PhDs in politi-speak. They can’t just come out and tell the American people, “Look, the knuckle-draggers you folks elected are complete buffoons, and they have the financial savvy of a geranium trying to balance a checkbook.”

Truth is never a defense in D.C.

And, so, bureaucrats learn to couch their messages in linguistic fabric-softeners like “somewhat” to keep mouth-breathers in Congress from pitching a fit. Think of it as Julie Andrews singing, “A spoonful of sugar helps the medicine go down…”

But make no mistake here: Yellen is trying to deliver strong medicine.

And her message is solidly on-point. It’s the same message I’ve been delivering with far more bombastic language for a long while now: Interest payments on US debt are going to sink the economy and the dollar, and quite likely bring a monetary and fiscal crisis later this decade that rips through American households and destroys the buck’s reserve-currency status.

I won’t run though all of that again. I’ve connected those dots about a million times, it seems like.

Instead, I’m just using today’s dispatch to show that even the highest-level bureaucrats in America are telling the captain that there’s an iceberg dead ahead… that it’s clear daylight and anyone can see what’s about to happen… that, while there’s no time to divert away from the crash to come, there’s still time to adjust course to limit the damage and save the economy, the dollar, and American households.

But is there anyone in government who is listening?

Not a soul, as far as I can tell.

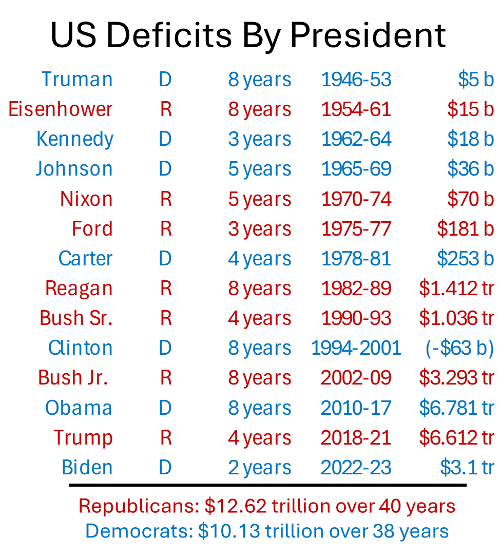

There are a few Republicans who mouth off about debts and deficits, when the GOP is not in power. But that’s just vote-gathering lip-service. The sad truth is that the GOP has actually racked up larger deficits than have Democrats since the end of World War II.

Let me share a chart just to show that I am not playing favorites here, just sharing facts:

Political affiliation truly means bupkis when it comes to careless spending. Both sides are geraniums trying to balance a checkbook.

All of which means America is not going to ease itself out of this fiscal trap it set for itself.

Yellen’s solution for Bloomberg was for America to increase its revenue.

Sounds logical.

But not practical.

Raising revenue as a government happens three ways:

- Personal/Corporate/Investment taxes. Not gonna happen. The rich control Congress and they’re not going to pay the allowance of the Congress-folk they own if those folks are going to raise taxes on the wealthy. And good luck raising taxes on the middle class. Milkmaid, meet stone.

- Grow the economy to grow tax receipts. That will happen at the margin as the economy naturally expands. But ain’t no way the US economy grows so fast that it outpaces government spending and, thus, creates surpluses that begin to shrink the deficit.

- Sell off assets. I mean, this isn’t a bad idea, frankly. Sell Yellowstone and other such national assets to Disney or whoever and let them run the joint. Impose all kinds of stipulations on what can and cannot happen at the park, and then share in the revenue generated. It’s a huge upfront payment Uncle Sam pockets to pay down some of the debt, and an ongoing stream of revenue without the associated costs of running the parks. Won’t happen, probably, but a good notion nonetheless.

Actually, there’s a fourth way: Counterfeiting money legally, as in printing more and more dollars to reduce the pain of current debt payments. Of course, that just makes tomorrow’s pain worse, as more money in the money supply means every dollar is worth less—i.e., inflation. But at least you get to live in order to die another day…

So, we’re stuck—the USS Sammy steaming toward an iceberg… and the captain is down below fighting with the cook about lumpy mashed potatoes.

No one is at the helm, as Yellen is softly pointing out.

Note: Janet Yellen is not a lone voice telling D.C. to pull its head out of its… assemblies.

Fed Chair Jerome Powell, JP Morgan CEO Jamie Dimon, hedge fund gurus Ray Dalio, Michael Burry, and John Paulson—among many others—are voicing the same concern.

At this point, ignoring the obvious would seem impossible. But somehow Capitol Hill manages to do just that.

So, as I regularly urge, prepare for the crisis to come.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.