Why Silver Hitting $300 Isn’t Crazy

The devil is having a moment…

A bit more than four years ago, I sent my monthly Global Intelligence Letter to subscribers recommending that they snap up silver, a highly volatile commodity known as the Devil’s Metal because of wild price swings that can destroy a trader’s wealth in a blink.

I told Global Intel readers that we were on the verge of a new silver boom.

At the time, silver was selling at just over $28 per ounce.

Today, it’s just $56.

So those who acted on my recommendation are up 100% in four years—19% per year. Not too shabby.

But there’s a bigger run to come…

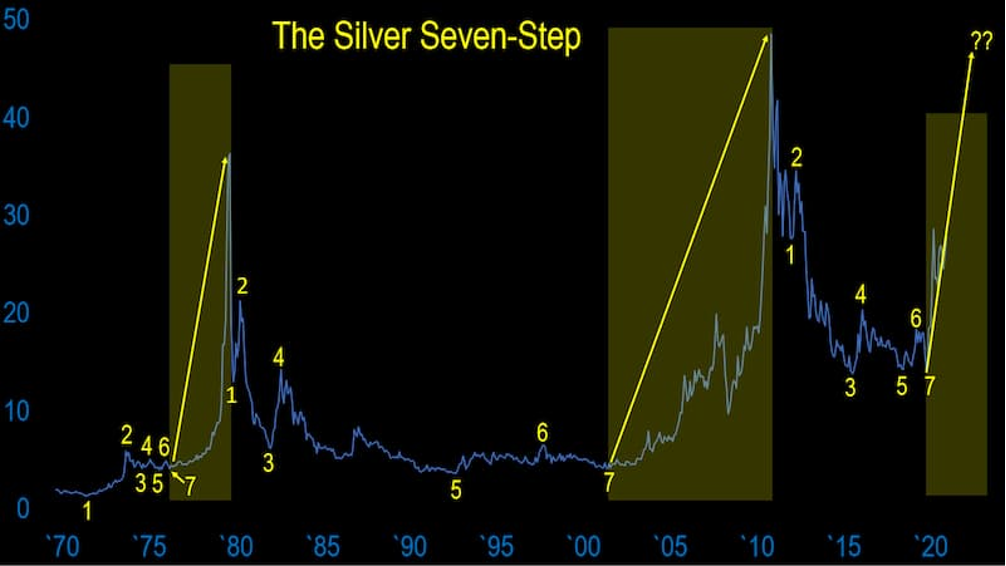

As part of that recommendation back in the summer of `21, I produced this chart:

It’s a chart I created based on what I labeled the “Silver Seven-Step”—a dance that silver does as it progresses from cycle lows to cycle highs.

These are the steps, as I explained to Global Intel readers:

- #1 starts the pattern after an asset has collapsed from a record high.

- #2 looks to be a move back to those previous highs, but that effort ultimately fails and collapses; no one has faith in the asset anymore.

- #3, #4, #5, and #6 are bulls and bears pushing and pulling on the price over time. Bears are trying to take it ever lower (#3 and #5), while bulls unsuccessfully try to recapture some of the lost glory (#4 and #6).

- #7 finally sets the asset for the ultimate move up. It’s bears trying once again to take the asset to lower lows, but just as the bulls failed to rally higher at step #2, the bears fail to kill the asset at step #7. The bulls swat the bears aside with force and send the asset moonward.

The most recent moonward phase, step #7, began in 2020.

Question now is: How high will silver go before the cycle starts anew?

If I had to guess… somewhere between $100 and $300 per ounce.

“Well, we now have proof that El Jefe is huffing the fumes from a spray paint can…”

You’d be forgiven for assuming that. Triple digits does sound a bit crazy.

And while I’m certainly not guaranteeing my prediction, there are reasons this is possible, maybe even probable.

Mainly: Even though silver has reached an all-time high… we’re nowhere near true all-time highs.

I know, I know… that’s a gibberish sentence.

What I mean is that silver hit $50 per ounce back in 1980.

Today, silver at $56 is higher nominally, but we’ve not yet accounted for inflation. Today’s $56 is less than $15 in 1980.

To reach true all-time highs on an inflation-adjusted basis, silver would have to hit $209.

So that’s why I say silver’s price sees triple digits exceeding $100, but likely topping out near $300 in a crazy, blow-off peak.

I also look back at those last two spikes silver saw in 1980 and 2011.

Across the 1970s, silver gained 2,600% before giving up the ghost.

Across the 2000s, silver gained nearly 1,100% before running out of oxygen in 2011.

This time around, we start with lows in December of 2015… a gain of 1,100% puts silver in the $165 to $170 range… and 2,600% lands us well above $300.

Granted, history is not Memorex (who remembers those TV commercials for cassette recorder audio tapes: Is it live or is it Memorex?). Prices do not automatically mimic what happened in the past.

But trends do tend to repeat.

The trend I care about is the Silver Seven Step that leads to the blow-off peak. Frankly, I don’t really care if the blow off is up 1,100% or 2,600% or some number between the two… or higher.

What I care about is that we are in a commodity super-cycle. We are in a new inflationary era (the Trump administration has hinted that we might have to accept that inflation is not going to return to 2%). And the world faces a persistent silver shortage.

To wit:

- The silver market has faced a supply deficit for eight consecutive years, with cumulative deficits exceeding 800 million ounces over the past five years, equivalent to nearly an entire year of global production.

- Industrial demand, particularly from solar energy and electric vehicles, has surged, with solar-related silver consumption expected to increase by 20% in 2024 and nearly 169% by 2030.

- Only 28% of silver comes from primary mining, meaning mining specifically aimed at finding silver. The rest is a by-product of mining other metals, particularly copper and gold, making it difficult to increase output in response to demand.

- The physical silver market is under severe strain, evidenced by something called

“backwardation” in the futures markets (basically: spot prices to buy silver today are higher than prices to buy it in the future, very often an indication of supply shortages). Moreover, rates to lease silver have spiked to 39% from a more typical sub-1%, signaling a genuine shortage of physical silver.

What I’m getting at here is simply that silver has not yet seen its ultimate highs.

Sure, Global Intel readers are up 100% so far.

But if my dot-connecting is right… well, we’ve got another 100% to go from here. Maybe even 200% or 300%.

Or more.

The devil is still dancing the Silver Seven-Step.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.