I fear that I have offended the ghost of Polonius. But so be it. The money’s just too good.

For those who don’t quite remember their high school literature class, Polonius is Laertes’ father in Shakespeare’s Hamlet, and he warns his son, “neither a borrower nor a lender be.”

Well, I am now a lender—though in a fashion Shakespeare could never have envisioned.

See, I am a lender on the blockchain. Specifically, I’m lending against pictures of monkeys, mad scientists, and other crazy images. Probably sounds like madness to most people. But stick with me for a moment. This is really interesting.

Until the rise of NFTs, or non-fungible tokens, the lending and borrowing that was taking place in the cryptoconomy involved borrowers putting up crypto assets such as bitcoin and Ethereum, and lenders often funding their requested loans with stablecoins such as U.S. Dollar Coin. It’s what’s known as decentralized finance, or DeFi.

Well, DeFi concepts have invaded the NFT space, and I am playing the role of banker.

Actually, I am playing the role of pawn-shop owner.

In the last couple of months, a new NFT lending service has emerged called Yawww.io.

The concept is simple: The owner of NFT X lists that NFT on the Yawww site, requesting a loan of a certain amount of Solana (the cryptocurrency Yawww uses). The lender agrees to the terms and funds the temporary loan.

The borrower repays the loan with interest within a few days, a few weeks, or a few months (depending on the terms of the loan), and the lender makes a decent profit.

If the borrower welches on the debt, the lender takes ownership of the NFT and can sell it to recoup the lost loan value.

Frankly, I’ve kinda become addicted to this. It’s almost like a game finding the kinds of loans I want to fund, based on the loan terms I care about, and tied to the NFT projects I’m willing to fund.

The money is good too.

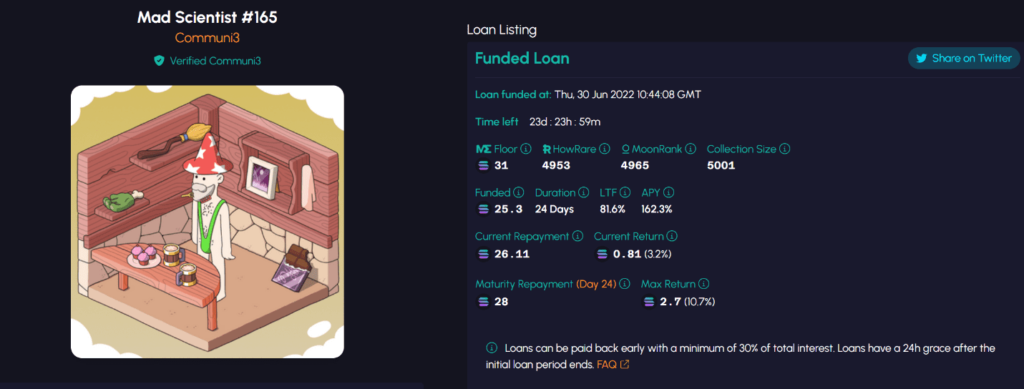

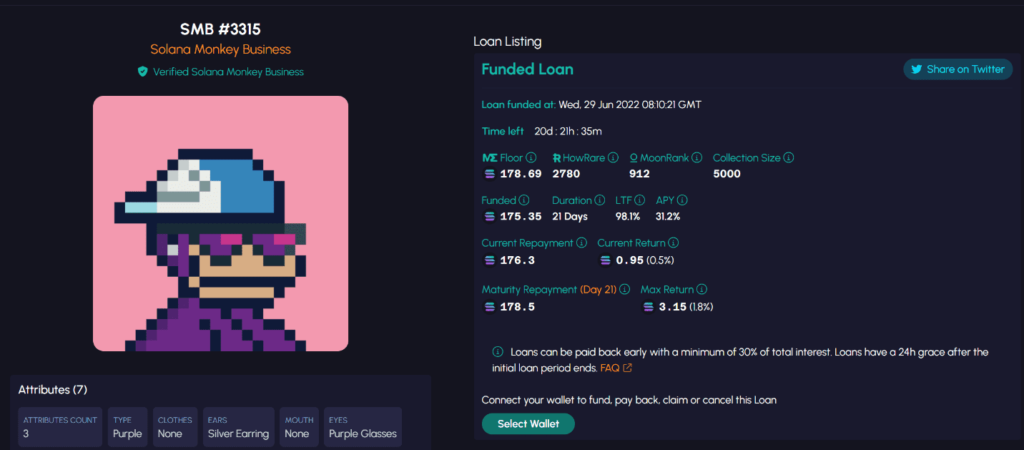

Here are screen-grabs of two recent loans I made:

Some of those numbers are probably a little too small to read, so let me break it down for you. The first loan at the top is a project known as Communi3, a utility NFT for which I will not bore you with the details. What’s relevant here is that:

- Communit3—the mad scientists—is a high-quality NFT project with a strong floor price of 31 Solana as I write this (the floor price is the lowest price a buyer must pay to own a Communi3 NFT).

- I loaned 25.3 Solana for 24 days at an annual percentage yield of 162.3%.

- And the LTF—the Loan to Floor—value is 81.6%, meaning I’m lending just 81.6% of the floor value of the NFT.

- Assuming the borrower repays me, I will collect 2.7 Solana, a 10.7% return on my 25.3 loan. (This is what the 162.3% APY is based on).

The second loan is for a project called Solana Monkey Business, arguably the bluest blue-chip NFT project on the Solana blockchain. Here what’s relevant in that:

- I loaned the borrower 178.69 Solana for 21 days at an APY of 31.2%.

- The loan is 98.1% of the floor value for what’s known as a “Monke.”

- I will recoup 3.15 Solana at the end of the period.

Assuming I am paid back on both, I will collect 5.85 Solana in just 24 days, or about $187 at a time when Solana is at $32 per token. The roughly 204 Solana I’ve loaned is worth about $6,527. So I’m picking up a 2.8% return overall in less than a month.

If I do this every month, I’m generating a return of about 35% per year on my cash.

Yes, there are lots of risks with this—meaning this is certainly not for everyone, particularly given the whipsaw nature of crypto in a bear market right now.

The biggest risk is that Solana crashes and the value of my crypto plunges. Of course, that’s a risk I face whether I am lending or not.

The other risk, of course, is that the borrowers could flake and leave me holding these NFTs.

But I am 100% OK with that. In fact, it’s part of my strategy.

See, I am only lending on NFTs that I want to own at lower prices, and generally I will only lend up to about 80% of the floor price. That gives me a good bit of wiggle room to relist the NFT and pick up a profit in case the borrower runs away.

If I end up with a Communi3 at 25, I’m good with that. I know I can turn around and sell it for a price somewhere in the low-30s.

If I end up with a Monke at basically 179, I am absolutely OK with that. As I noted, these are the bluest blue-chips and they routinely sell for well over 200 Solana. With this particular Monke, I might even keep it and add it to my collection of long-term holdings because I know in a bull market a Monke is worth closer to 300, based on historical sales. Not a bad return ultimately.

So, yeah—Polonius is probably unhappy. But when I can generate basically 3% per month in gains lending against high-quality NFTs, well just call me a pawn star.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.