The Powell Probe Could Break the Dollar

The dollar just took a punch to the gut—and it wasn’t from inflation or debt this time.

This hit came from Washington itself… and I’ve a hunch that it’s all part of a plan.

I’m going to assume that by now you’ve seen that the comically named Department of Justice has launched a federal criminal investigation into current Federal Reserve Chairman Jerome Powell. Apparently, the DoJ believes Powell perjured himself in testimony before a Senate committee when talking about long-overdue renovations to the Federal Reserve building.

If you’ve been a Field Notes reader for longer than a minute, you know I think Powell has done a stellar job at bumbling his way through his term as Fed chair, particularly regarding his post-COVID assertion that “inflation is transitory.”

Inflation was never going to be transitory, as I pointed out in Field Notes long before inflation emerged.

That said… I don’t believe Powell is a criminal and that his testimony was perjurious.

The only thing Powell did wrong was ignore Donald Trump’s insistence across all of last year that the Fed lower interest rates to 1%. Powell scoffed at that, and was right to do so. Trump is no economist and was not hired to make calls on interest rate policy.

That’s the Fed’s job.

Trump’s job is to steer clear of Fed independence.

Alas, we’ve now broken that boundary with the DoJ launching this investigation.

Which is terrible news for the notion that the Fed is an independent agency.

The Fed has been independent ƒsince its inception. And that perception of independence globally is a primary reason the world has long had faith in the dollar and US Treasury debt. The US economy, investors believed, was not beholden to any political party or any external efforts to manipulate the economy.

This investigation, however, now tells the world that the Fed is now a Trump chew-toy… that if the Fed doesn’t kowtow to Trump’s views on interest rates—then the Fed chair will have the long arm of the law to contend with, even if he’s done nothing wrong.

That’s the death of Fed independence.

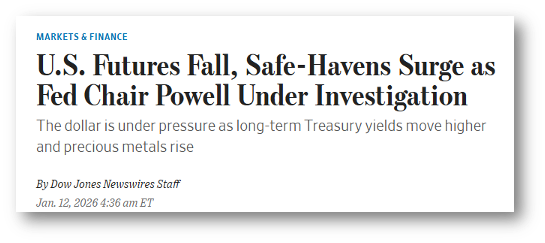

Let’s consider this headline from the Dow Jones Newswire from early Monday morning:

Pay attention to “safe-havens surge” as well as “the dollar is under pressure.”

Historically, those two realities never partied together.

Until now, the dollar was the safe-haven for the world. Dookie meets fan… the dollar rallied as investors around the globe rushed into the safety of Uncle Sam’s money.

Now, however, the White House’s legal lapdogs are directly attacking Fed independence, and no one rushes into the safety of the dollar. Instead, they flee the dollar and move into precious metals.

As I write this, gold is up nearly 2% and is within five bucks of a new all-time high. Silver is up more than 5% and is about 50 cents shy of a new historic high.

The dollar… it’s down 0.5%, which is a significant one-day move in currencies.

Expect more of this across 2026.

Trump says he has no idea what the DoJ is doing with Powell. On an unrelated note, I have some beachfront property in Arkansas for sale, in case you’re interested…

My bet is that Trump will use the DoJ’s investigation as pretext for firing Powell before the Fed chair’s term ends this spring. Trump is desperate for lower interest rates because the economy is flailing under his command, and he wants a sock-puppet in place at the Fed sooner rather than later so that Trump can manipulate interest rates lower. (Sidenote: Lowering rates to 1% will prove even worse for the economy and the dollar, you read it here first.)

To the world, the investigation of Powell is proof that the next Fed Chair will almost certainly be a Trump yes-man… that the arbiter of the world’s largest economy will be making decisions based on the whims of a mercurial TV caricature rather than hard data.

That is a horrible turn of events for the dollar.

But as I noted at the top of today’s dispatch… maybe a horrible turn of events is exactly what the Trump administration wants for the dollar.

Maybe this is all premeditated.

As I’ve noted a number of times over the last year, Team Trump has been telegraphing its desire for a weaker dollar on the (wrong) assumption that a downtrodden dollar will bring manufacturing back to America. (It won’t. Nike’s highly skilled factory workers in Vietnam, for instance, earn $150 to $250 per month. In what universe does Nike bring manufacturing back to America, where the shoemaker would have to pay $4,000 to $5,000 per month or more—plus benefits—for factory workers?)

Just maybe investigating Powell so publicly is specifically designed to undermine the dollar.

But who knows?

What I do know with certainty is that the dollar faces a very difficult year. I mean, 2026 was always going to be a bear of a year for the buck, but this investigation weakens the dollar’s structural supports even more.

There’s a reason gold and silver are up in the wake of the investigation.

Take the hint.

Dump some of your dollars now and own gold and silver. Own Swiss francs, which by the way, are up more than 0.5% since the Powell investigation hit the news.

The dollar is losing safe-haven status quickly.

Stay tuned…

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.