The bear defaulted.

And I am quite happy with that outcome.

But let’s back up to a previous dispatch I sent to you about my new preoccupation: lending against NFTs (you can read that dispatch here).

For a few weeks now, I’ve been using a website called Yawww.io. It’s a lot like an online pawnshop for NFTs.

NFTs, or non-fungible tokens, are one-of-a-kind cryptos that gained fame as digital art but which over the last year have morphed into assets that provide all sorts of products and services—from online gaming to tech investing to passive-income opportunities.

At Yawww, NFT owners looking to raise a bit of capital for whatever reason can list the NFTs they want to pawn, how much Solana cryptocurrency they’re looking to raise, the time frame over which they will repay the loan, and the amount of interest they’re willing to pay.

Folks like me, with liquidity to spare, scroll through the loans and if we find one with parameters we like, we click to fund it. The process takes a few seconds.

I have now funded five loans, and the first two have come due—which is what this dispatch is really all about. It’s an update on how the system works, and what happens when a loan defaults.

Because one of those two initial loans did default—a loan for 80 Solana, or about $2,700. But we will come back to that very shortly.

First, the other loan actually paid off early.

It was a loan I made against an NFT project called Solana Monkey Business, what I’ve routinely referred to as the bluest of blue-chip NFTs on the Solana crypto network. One of the granddaddy projects that, similar to Bored Ape Yacht Club on Ethereum, is a measure of status.

This is the NFT:

I originally funded a loan for 159.35 Solana at a time when the floor price for a so-called Monke was 190, meaning I put up about 84% of the floor value. I did this because, just in case of default, I wanted to be able to list this Monke at the floor price and recoup all of my original loan, plus the interest I would have earned, plus a bit more.

In return, I was set to earn 3.15 SOL for a loan slated to last for 14 days. That’s an annualized return of 51.5%.

Turns out this Monke’s owner was not about to let it go. He/she repaid early, after just nine days. I collected 2.03 SOL, about $67, in just over a week…and with what I would call very minimal risk, given the quality of the Monke project and the demand to own these NFTs.

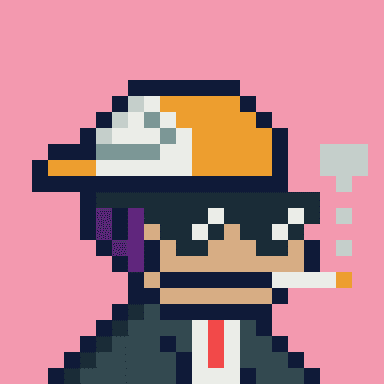

And then there was the Okay Bear NFT I lent against. This one:

I loaned the owner 80.33 SOL when the floor for an Okay Bear was 98—a loan-to-floor value of 82%. For a nine-day loan, I was set to receive 2.97 SOL in interest, or 150% annualized yield.

Great numbers in that I was getting a huge return, and I have a large margin of error to cushion me in the event the value of Bears turned down.

Well, after nine days, this Bear’s owner did not return to claim his NFT. Meaning, I did not get back my 80 Solana or the interest owed.

Instead, I got the Bear.

But I was quite fine with that outcome because Bears are a quality project and have remained in the 99 to 100 range. In fact, I have this bear now listed at 101.01 Solana on the Magic Eden NFT marketplace. It’s the third bear up for sale, behind one priced at 99 and another at 100.9…which means this bear will almost assuredly sell at my price.

When it does, I will collect 91.414 Solana, after artist royalties and marketplace fees.

So, instead of walking away with a 2.97 SOL profit, I will instead collect more than 11 SOL—more than 3x my expected interest payment.

To my way of thinking, lending against high-quality NFTs is a pretty good way to earn Solana without much effort. There is some risk that Solana’s price declines, but by lending only against blue chips, I am OK with that risk because I know the project will maintain demand and long-term value.

Assuming the remaining three NFTs that are outstanding repay as expected, I will earn 20.989 SOL (around $700) over a span of just 24 days—an annualized return of 91% on my initial 484 SOL outlay. Not bad for less than a month’s worth of (minimal) effort.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.