Let’s pick up where I left off yesterday with Abracadabra, or ABC, a new NFT that launched recently and which serves as proof that the NFT market is not dead…not even remotely dead, as the oh-so-wise mainstream media have been exclaiming recently.

I noted in yesterday’s dispatch that “NFT investors are looking for truly valuable and viable projects where they feel more secure sticking their money. ABC is one of those projects. Others exist, though they exist in smaller numbers these days (and I will tell you about one soon).”

Well, this is “soon” and I am back to tell you about that one…y00ts.

This NFT, or non-fungible token, is an offshoot of the single most expensive project on the Solana blockchain—a project known as DeGods. It launched Monday afternoon to great fanfare.

The buildup was weeks in the making. Those who wanted to mint a y00ts—those who wanted to participate in the initial launch—had to fill out a three-question application that the DeGods team read through to determine who would and would not make the so-called “y00tslist.”

To mint, you needed 375 DUST, the in-house DeGods cryptocurrency. Depending on when one purchased DUST, the price for minting a y00t ranged from less than $300 to more than $1,200—a decidedly pricey proposition.

That’s one of the reasons I didn’t talk about this project in advance. I knew the price (and the risk) was going to be ludicrously high, and the demand was going to make landing a whitelist astronomically challenging.

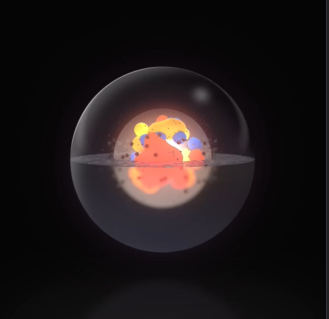

Indeed, more than 71,000 applications arrived—proof in and of itself that NFTs are far from dead. Only about 8,500 were selected. Somehow, I was one of them. I woke up Tuesday morning, during the 19-hour minting window, and minted my y00t t00b. It’s the precursor to a y00t, and owners can either keep their y00t in t00b form or transform it into a y00t. There is a strategy why one would not transform, but that’s getting too far into the weeds for this dispatch.

This is my t00b:

Within minutes of y00ts minting and listing on Magic Eden, the leading NFT marketplace on Solana, the t00bs were selling for 200 Solana, or about $6,200. They’ve settled in the 150 range, or just under $5,000.

My 375 DUST cost me about $600…meaning my $600 investment has increased by more than 8x in just days. (And I could have sold for nearly a 12x gain in just seconds.)

That is not the definition of “NFTs are dead.”

Again, I’ll offer what I offered earlier: NFT investors are looking for truly valuable and viable projects where the feel more secure sticking their money.

Y00ts is one of those projects because of the reputation of the DeGods NFT team. DeGods themselves have jumped to more than 500 Solana from less than 5 Solana in early spring.

Which is also an example of “NFTs are not dead.”

Dead investments do not 100x to become the most valuable project on any particular blockchain.

Moreover, I look around the NFT space and I don’t see wholesale death. I see projects that came down from aerie heights, but which have found a floor amid the bear market.

And why did they find a floor? Why did they not just go to zero and fade away completely, which is what “NFTs are dead” would otherwise imply?

Because they have utility and, thus, ongoing value. The media seem to miss that fact in their desire to paint NFTs as a fanciful fad, no different than, say, Beanie Babies of the 1990s (which one writer laughably referred to them as recently).

I look at Portals, the leading metaverse play on Solana, and it has found a solid floor in the mid-20 Solana range. Blocksmith Labs, a utility play for the NFT industry, has seen its price push north of 100 SOL from less than 4 SOL in March.

MetaHelix, another utility play, this one for managing Discord social-media servers, traded as low as 0.75 SOL in May…and is now north of 4 SOL—a move of more than 5x. Plus, MetaHelix spits out dividend-like payments every two weeks from its successful, growing and profitable business operations, and has already distributed an amount of Solana equal to nearly half the NFT’s original price.

Only a fool—or reporters who don’t understand the industry they’re writing about—would argue that describes the death of NFTs.

To the contrary, MetaHelix, Portals, Blocksmith Labs, y00ts, ABC, and many, many other projects, are proof that NFTs are working as I said they would. They are moving well past their original purpose as digital art and are increasingly representing real companies with real businesses that are generating real income…and in many cases are sharing that income with NFT owners.

No different really that Apple or Microsoft continuing to build a business in a down economy and a bear market on Wall Street, and sharing with shareholders part of their profits in the form of dividends.

Y00ts is a very high-profile example of this, if only because it’s opening price was the highest for any NFT I’ve yet seen. But it won’t be the last example.

The NFT market continues to mature and expand.

There’s a saying that in a bear market you stick with the builders.

Well, as someone who is deeply entrenched in this industry, I can guarantee that the builders in the NFT space are building away. And when the bull market returns—as it always does—a lot of projects are going to create a huge amount of wealth for the investors who are using this moment to buy a certain collection of deeply discounted NFTs.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.