How Low Can a Dollar Go?

Once upon a time, not so long ago, there was a question I cared about: Can bitcoin really hit $1 million?

These days, I’ve given up on that question because of a more pressing query: Is there a limit to how high bitcoin can go ultimately?

The answer: No.

The reason: Because there is no limit to how low the US dollar can go.

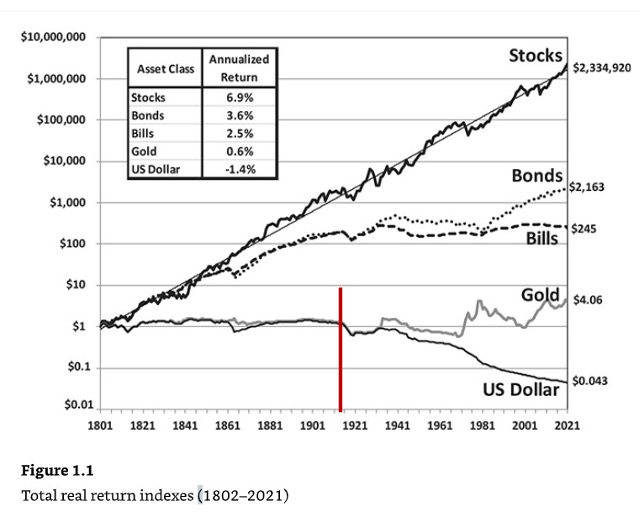

I used this chart in yesterday’s dispatch, and I am reviving it for today’s because it so dramatically conveys a truth most Americans have yet to grasp…

That’s the value of various assets since 1801. (The original chart is from Dividend Growth Investor.) I added that red line because it marks the birth of the Federal Reserve.

America’s central bank was supposed to act as a buffer mitigating the financial panics, crises, and crashes that plagued the young country in the 1800s and into the early 1900s.

However, clearly, when you look at the chart, the dollar survived pretty well without a central banker…

But then along comes the Fed to “manage” those crises, and the dollar… becomes a shell of its former self.

The value of a dollar continues to drop every year.

Which is why I say there is no limit to how low the dollar can—and will—go.

Which is why I now say there is no limit to how high bitcoin can go…

To be clear, I am not talking about how high bitcoin can go in this current bull market. (I calculate that number somewhere between $175,000 and $280,000… maybe even higher… as I detail in the March issue of Global Intelligence.)

I’m talking about the longer term, like over the rest of this decade and beyond.

See, as much as bitcoin is a (volatile) crypto investment, it’s also an anti-dollar currency, much like gold.

Savvy savers and investors are putting some portion of their wealth into bitcoin as a way to protect against inflation and the dollar’s ever-eroding purchasing power. A financial planner recently told Bloomberg his firm is seeing investors allocate 3.5% to 5% of their wealth to bitcoin.

It’s an amount that, if entirely lost, would not impact the portfolio meaningfully. At the same time, it’s an amount that would generate hugely outsized gains if bitcoin really does have unlimited upside over time…

Asymmetrical risk—with the asymmetry leaning heavily toward reward. That’s the way to protect your wealth without putting much capital at risk.

In our lifetime, I’d venture a guess that we are not going to see a reversal of the dollar’s long-term fortunes.

Sure, it will rise here and there against other currencies.

Then again, most other fiat currencies are just as trashy as the dollar. (The Swiss franc, Singapore dollar, and Norwegian krone excepted.)

But against inflation, the dollar hasn’t got a chance in hell of winning that fight.

That’s because it has the Fed “managing” the situation.

The Fed wants inflation because the US government needs inflation. It’s the only way to manage excessive debts. The more the dollar declines in value, the easier it is for the government to repay its debts with increasingly worthless dollars.

It’s all premeditated.

Some might say that’s presumptuous of me to say…

Alas, that’s not my analysis. That’s what the chart shows us. If the dollar was up and down over time and with slight drift lower, that’s one thing. But when the line is a ski slope… there’s no other way to read that data. It’s the Fed’s premeditated murder of the dollar—designed on purpose to happen slowly.

No one pays attention when the poison takes effect slowly.

But then you wake up one day… and you realize you’re not at all well…

Those in the know realize that bitcoin is the antidote to the poison. Gold, too, of course.

But bitcoin is the asset that has no upper limit. Gold ultimately has a limit—I’d say in the range of $7,500 to $10,000 per ounce.

That’s largely because it’s neither portable nor easily spent.

Bitcoin is both.

And, so, bitcoin is going to be widely adopted globally as fiat currencies, led by the dollar, decline into worthlessness.

So, how high can bitcoin really go?

Pick a number, any number, between $1 million and infinity.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.