Invest now—or miss out.

Well, one of my predictions for 2024 has already been torched.

In an earlier article I suggested that after the many changes to Golden Visa policies in 2023, most European countries would leave things alone this year.

But Greece decided to ruin my track record for prognostication.

It’s only February, and the Greek government has announced it’s planning to raise the threshold for Golden Visa real estate investments in the most desirable areas to €800,000, up from the previous threshold of €500,000—itself a recent increase.

Fortunately, the minimum investment outside big cities and the more popular islands will remain at €250,000.

Although Greece is almost as politically divided as the US, the official opposition party heartily endorsed the plan. That means it’s not just a pet hobby horse of one faction. Getting Greeks to agree on something this quickly isn’t easy.

As was the case in Portugal last year, the main complaint is the Golden Visa’s impact on local housing costs.

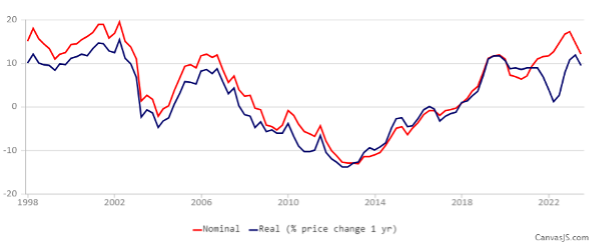

House prices have gone up by double digits in the last two years, peaking at 15% year-on-year in the first quarter of 2023.

Housing costs were on a long-term downward trend until 2013, when the Golden Visa policy was first adopted, but have been rising since then…

Foreign buyers account for 80% to 85% of all real estate purchases in Greece. But it’s not just the quantity of foreign buyers worrying the locals. It’s also where they’re coming from.

As was the case in Portugal, Chinese nationals account for over 80% of Golden Visas. In both countries, most Chinese visa holders have rented out their properties rather than living in them. That’s compounded opposition to the program.

Many press reports cite anecdotal comments from Greeks saying it’s nearly impossible to find a place to live in Athens or Thessaloniki. Neighborhoods like those around the Acropolis are increasingly dominated by Airbnbs.

Three weeks ago I reported that Australia had abruptly cancelled its own Golden Visa program, also dominated by Chinese. In that case the problem was that most Chinese visa holders were not contributing any skills or investment to boost the local economy. The net benefit of inward investment into the residential housing sector was negated by rising housing costs for locals and tax expenditures on the social safety net for these immigrants.

This confirmed my overall read of the global investment migration environment…

Residency via investment in residential property—adopted by governments as a short-term way to get cash after the global financial crisis—has run its course.

Instead of welcoming immigrants on the basis of one-off investments in housing, governments prefer foreigners who will bring in a steady stream of income from abroad…

That includes retirees, digital nomads, and other people of independent means who will spend foreign money in the local economy every month.

For North Americans looking to acquire long-term residency abroad, the message is clear…

Make your property investment as soon as possible to avoid price rises… or plan to go the independent means visa route.

Join my Global Citizen service, and I’ll be happy to help you decide the best route for you.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.