One Day, Gold Will Fall… But Not Anytime Soon.

“Hey, Jeff…”

I heard the callout as I passed a few guys sitting at a round banquet table in a late 19th-century resort overlooking Dublin Bay and the Irish Sea.

We’d all descended on the Irish capital for the Future of Wealth event I hosted last weekend.

I stopped and looked and saw an attendee, Ron F., extending something toward me that momentarily caught the overhead light and glittered.

“Ever seen one of these?”

I took hold of a golden, flexible piece of polymer and gave it a gander.

“It’s gold,” Ron told me. “Real gold—you can melt it down. It’s spendable. Merchants are taking these now.”

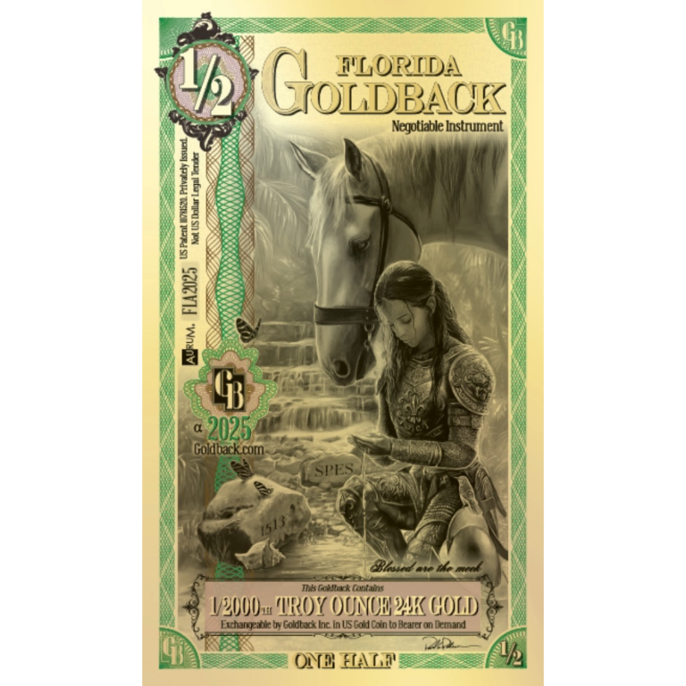

What he’d given me was a Florida Goldback—a polymerized currency note fabricated from .999 pure gold. The one Ron handed me carried a denomination of ½, in this case meaning 1/2000th of an ounce of gold. This is the one I was holding:

“This is really cool,” I told Ron and those who had gathered around us.

“Keep it.”

I did.

Thanks, Ron!

Sitting in the wood-paneled bar of a truly lovely, early 18th-century hotel in Waterford, Ireland a day after the event concluded, I’ve settled into a comfortable corner booth, ordered a dram of Red Spot (one of the best Irish whiskeys), and I’ve started digging into these Goldbacks and what they represent.

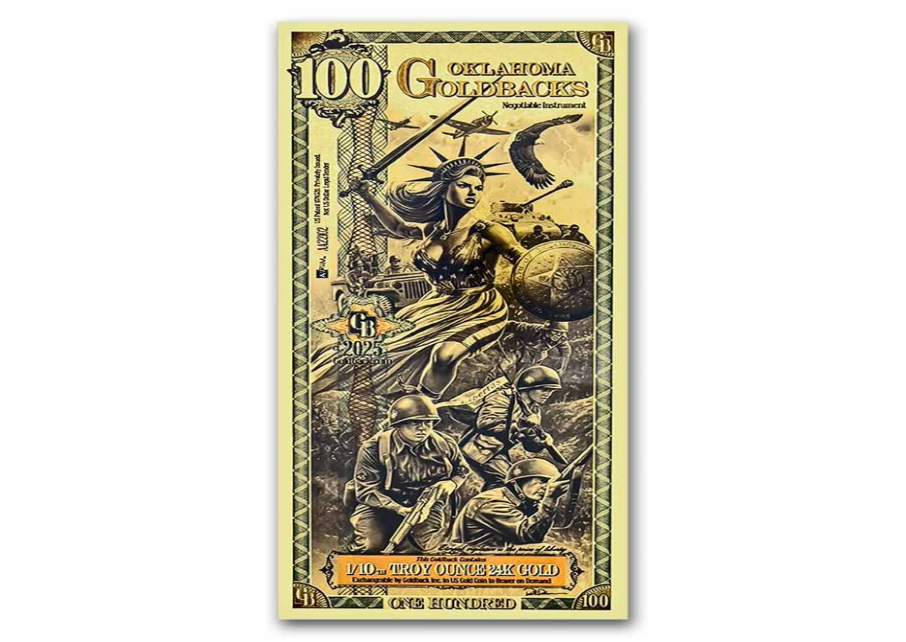

Apparently, eight states now have Goldbacks—Arizona, Florida, New Hampshire, Nevada, Oklahoma, South Dakota, Utah, and Wyoming. More than 2,000 merchants across the country officially accept Goldbacks as a legit form of payment, and thousands of other small businesses unofficially accept them.

And what are they, El Jefe?

Basically… they’re real money. Not Federal Reserve Notes (i.e., US dollars) that are actually debt instruments, rather than money in the honest sense of that word.

Goldbacks are money. They’re hyperfractionalized pieces of pure, 24k gold pressed dollar-thin and sandwiched between polymer sheets and emblazoned with really nice imagery that recalls when America was the land of promise and hope. (They’ve been independently tested and verified to prove they contain either the right amount of gold per denomination, or slightly more.)

Now, I’m not writing today’s dispatch to convince you to go stock up on Goldbacks. Truthfully, they’re kind of expensive. The ½ Florida Goldback that Ron gave me sells at retail for about $4… but the underlying gold is worth half that. The 100 Oklahoma Goldback—1/10th of an ounce of pure gold—sells for $800 when the gold is worth $400.

(Honestly, I’ll probably buy some anyway because I think they’d look cool in my new office in a frame on the wall.)

Instead, I tell you about these because there’s a much bigger message—a message I shared on stage more than once at the Future of Wealth event: The world, including lots of Americans and American merchants, are increasingly distrustful of the US dollar.

As always, I come with receipts, not just me spewing baseless opinions into the universe.

A few days before I showed up in Dublin, news emerged that for the first time in decades, the world’s central banks now own more gold than they do US dollars. They’ve been dumping greenbacks to buy the primary ingredient in Goldbacks.

Gold prices, meanwhile, are just shy of $4,100 per ounce as I write this, after hitting the $4k milestone last week. As I told Future of Wealth attendees, “that’s not because physical gold is a great investment. Physical gold doesn’t do a single thing to earn any money or pay any interest or dividends. Gold is going up because the dollar is a bad investment.”

The current administration has told the world it wants a weaker currency. I am taking the administration at face value.

The rest of the world is too.

Meanwhile, tariffs and deportations are beginning to have inflationary and negative job/workforce impacts on the US economy.

The rest of the world sees that too.

And so, gold is taking on a shine brighter than it has ever had before.

I see lots of mainstream commentators saying gold prices are at risky levels now. The Financial Times ran this drunken spittle of a headline a few days ago: “Gold Bubble Should Prompt Central Banks to Sell the Metal.”

That vibe matches the famous BusinessWeek cover from 1979 declaring the “Death of Equities,” just before the US stock market launched into a multi-decade bull market for the ages.

Over our weekend in Dublin, I had a colleague use the phrase, “Monty Python’s Upper Class Twit of Year” and that pretty much captures what I think about the FT’s headline.

I mean, where are central banks supposed to put the proceeds from their gold sales (if they stupidly follow the FT’s addled advice)? The dollar? Why would anyone trade a fundamentally strong asset (gold) for a fundamentally weak and weakening asset (the dollar) in which the government in charge of said asset is openly telling the world it wants to devalue that asset?

Make it make sense…

On the last day of the event in Dublin, an attendee asked a smart question: “What causes gold to crack finally and fall in value?”

Answer: It would require the US government to implement a legitimate plan to pay down the debt and to stop spending like a crack addict who found a lost credit card in a dark alley.

And that ain’t happening anytime soon.

“Gold will fall in value—one day,” I told him, “But it will see $10,000 before it ever sees $1,000 again.”

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.