I popped into a Chinese pharmacy today.

I’m attending the TOKEN2049 crypto conference in Singapore. My wife, it turns out, is a big fan of traditional Chinese medicine, and when she learned I was spending a few days in this part of the world, she texted me some pictures of some Chinese meds she wants.

While I was in the pharmacy, I asked the traditional Chinese pharmacist if she had anything for a headache/neckache. She glanced down at the piece of black cloth tied around my wrist and emblazoned with “TOKEN2049” in white.

“The crypto conference?” she asked. And before I could answer, she said, “Bitcoin gives me a headache too.”

I couldn’t hold in the laugh. I think I kinda snorted. She smiled, and handed me a box of “Joint-Relaxing Capsule,” and sent me on my way.

I mean, I totally understand where she’s coming from. If you’re a typical crypto investor—and I get the feeling my Chinese pharmacist was just that—the crypto downturn has been headache-inducing, no doubt.

But if you’re active in the crypto markets daily, and you’re talking to the insiders and the developers who are building blockchains and all the different cryptos and services riding along those blockchains, you see the market from a very different perspective.

With today’s dispatch from the TOKEN2049 conference at the Singapore Convention Center, I want to share with you some of the more interesting comments and quotes I jotted down during my time here.

If nothing else, they give you some insight into why I remain unflinchingly bullish on crypto and NFTs, despite the bear market. (Indeed, I just added to my NFT collection before I started writing this dispatch because the price for a MetaHelix NFT, which I’ve written about, had dropped to less than 3 Solana.)

In no particular order, here are the comments I heard and why I think they’re relevant:

- “Someday, everyone will have a PFP because they will be so useful in life.”

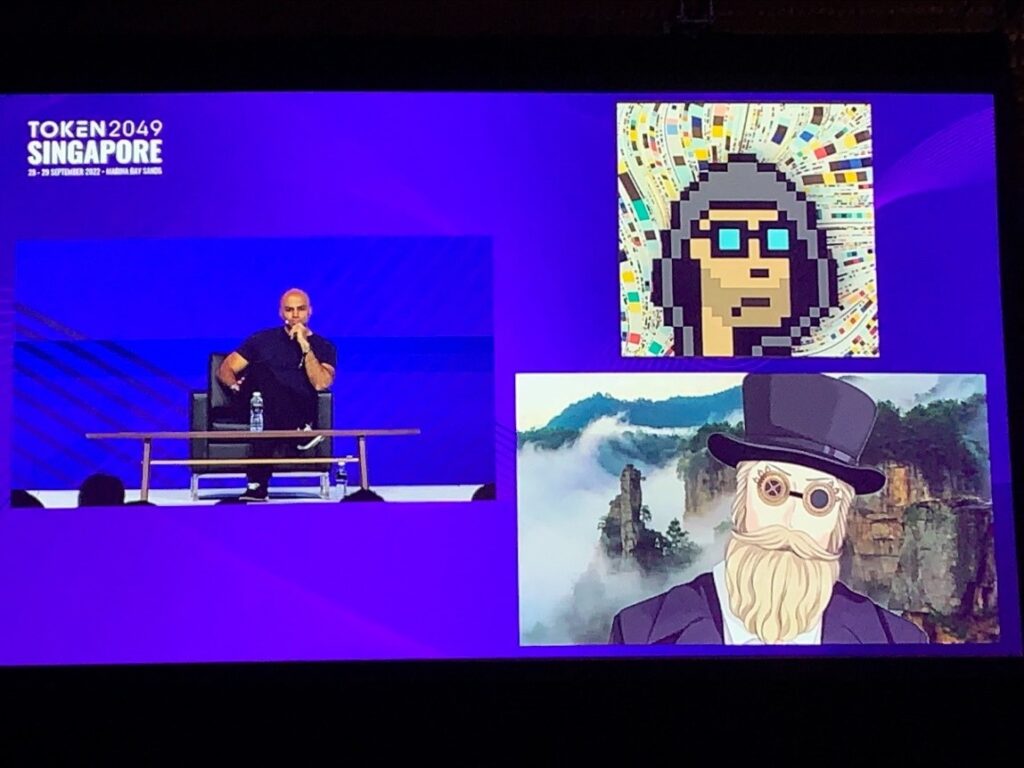

That was an anonymous speaker known only as Punk 6529, a reference to the Crypto Punk NFT he owns. His comment speaks to the metaverse and the idea that the internet of tomorrow is going to be pervasive, and that it will redefine social interaction online. We will all be avatars of ourselves or our favorite PFP, or “profile picture.”

I wrote about this idea much earlier this year. Avatars are going to be as ubiquitous as smartphones before this decade is out. So, there’s a huge investment opportunity there, in owning the best, most sought-after avatars.

Next, a couple of quotes about NFTs, or non-fungible tokens, the crypto assets that started off as digital art but which have morphed in pieces of a business, not unlike shares of stock.

- “NFTs are the path to mass adoption [of crypto], and it will happen.” (Jon Vlassopulos, Napster CEO)

- “NFTs are the Trojan Horse of the blockchain. They’re going to lead the crypto revolution. … Every single citizen on the planet will interact with an NFT—it’s inevitable.” (Mike Novogratz, CEO of Galaxy Digital, a crypto investment fund)

The point: NFTs, as I have been writing now for the entirety of 2022, are going to invade our lives in a million ways. Shopping, gaming, government IDs, financial assets. In many instances, people might not even realize they have an NFT, which is what those two quotes are noting.

Average people are going to wake up one day and realize they own NFTs accidentally. Others are going to be dragged into NFTs by way of companies like Walmart, which just announced new moves into the metaverse. Again, as with avatars, NFTs are going to be a monstrously large investment opportunity.

- “Short-term, the Federal Reserve will push until it breaks stuff, and we’re close to the Fed breaking stuff. Longer term, a generation that understands [crypto] is not going to sell it easily. People will not sell, and that could lead to explosive prices” for bitcoin.

That was Jordi Alexander, chief investment officer at crypto investment fund Selini Capital. And his point is that bitcoin is a very limited asset—just 21 million coins will ever exist. Most of those are locked up, with estimates that only 3.5 million actually trade.

That’s 3.5 million for 8 billion people on the planet. Even if we reduce the number of potential buyers by 90%, that’s still 800 million potential bitcoin owners. Right now, an estimated 114 million people in the world own at least a piece of a bitcoin.

Where does the price go when an additional 700 million people (or more) try to own a piece of bitcoin as well?

Jordi is basically saying what I’ve been saying for a while: Bitcoin will see much higher prices. I remain committed to my belief that bitcoin crosses the $1 million mark this decade. When crypto goes mainstream—and it will—bitcoin is going to fly.

Suffice it to say, this has been an engaging crypto conference, and I’ll have more tidbits to share in my columns in the days and weeks to come.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.