Would you consider FedEx a big company? It’s an inane question, but I have a point to make.

With a stock market value of roughly $75 billion, the overnight delivery giant ranks 105 on the list of S&P 500 companies. So, basically, I’m answering my own question to say that, yes, FedEx is big. Huge, really, on a global scale.

Now, the point of this exercise in rhetorical questioning: As of early May, $78 billion is now invested in decentralized finance, known simply as DeFi.

If you’re unfamiliar, this is the relatively new, and absolutely explosive, corner of the cryptocurrency universe where folks like me are earning the equivalent of interest payments on our crypto that range from a few percentage points to well over 1,000% a year.

Yes, some of that is risky. Quite so. Then again, some of it is as sedate as an octogenarian napping in a Barcalounger.

But risk isn’t really our issue, though. It’s the money.

I regularly write to you about the cryptosphere, and with good reason: This is the time to invest in the future before the future is the present. DeFi is a fabulous example of what that future-present is going to look like.

In short, it’s personal finance conducted on the blockchain. Which means, it’s personal finance without the middleman stealing part of your profits.

I’m talking about saving money. Buying stocks. Buying options. Buying insurance. Taking out loans. Sticking funds into a money-market account. Owning foreign currencies. Day-trading. And opportunities that simply don’t exist for Main Street investors, such as investing in accounts receivables or music royalties.

All of this—and so much more—is in the process of upending the traditional, financial world that you and I have known our entire lives.

Frankly, DeFi at the moment is a madhouse of possibilities and opportunity. And it can also be wildly confusing to navigate—and that’s coming from someone (me) who’s playing in the space daily. That’s not to say all of it is confusing. There are many avenues in DeFi that are no more challenging than opening a bank account online.

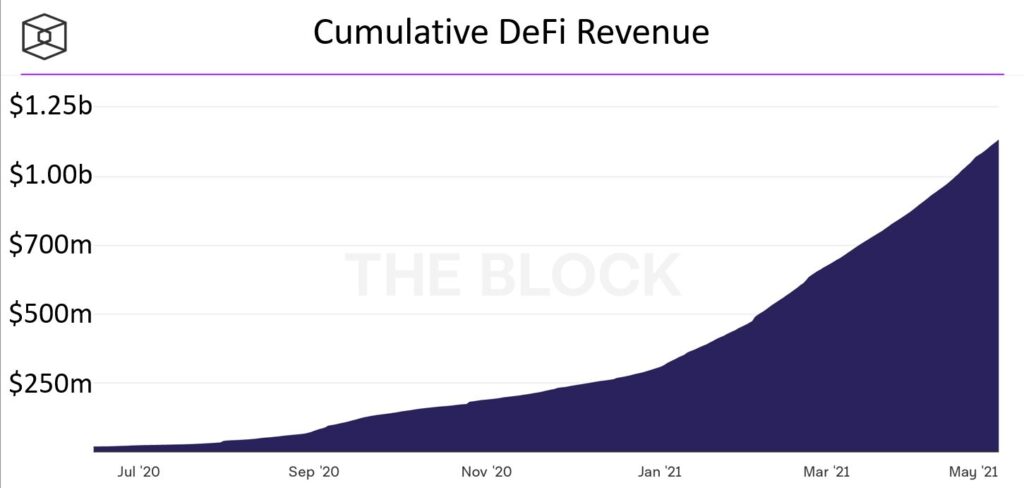

But complex or not, I force myself to learn this because of the opportunities that exist. A report I saw earlier this week noted that in April alone, the DeFi system generated $252 million in payments to crypto holders like me.

This is what the cumulate amount of DeFi income looks like over the last 11 months…

That’s from The Block, which tracks crypto data. It’s a moonshot of money that’s only going to explode higher from here because, frankly, DeFi has really only been a thing for just over a year now. I’ve been active in it since late last summer, a measure that means I’m a DeFi geezer.

But it’s certainly been worth the effort to learn about and understand this emerging personal-finance space.

With one cryptocurrency, Allianceblock, I’m earning interest in excess of 120% a year. With another, PancakeSwap, it’s more than 140%. With a third, Stater, it’s 208% at the moment. One of my “worst” investments earns a measly 8.6% on U.S. Dollar Coin, a so-called stablecoin that basically stays pegged at $1. (Another note: None of those are recommendations; my risk tolerance might be different than yours, and with some of those you have to know how to move crypto around, and trade one token for another, etc. Nevertheless, I want to give you real examples of what a real investor you can trust is actually earning on his crypto investments.)

The crazy thing to me in that last sentence is that I labeled 8.6% “measly”…because in a world where saving dollars in a bank account earns financial dust, 8.6% sounds downright Himalayan.

Yet in crypto…well, 8.6% is just the beginning of the opportunities.

I haven’t calculated how much I’m actually earning on a monthly basis from my various crypto investments, but I can tell you that with PancakeSwap (one of my newest), every $1,000 earns 2.03 PancakeSwap tokens per month, which are worth a combined $80 at the moment. So, about 8% per month. (That fluctuates with the value of the PancakeSwap token. If it flags, my yield tanks. If it rises, my payments—past and future—will be worth substantially more.)

I know all of this can seem confusing. I was confused when I first started nosing around in DeFi. That was the impetus, however, for a special report on DeFi that I recently wrote and that I’m releasing later this month. It’s everything you need to know to understand DeFi, as well as a step-by-step guide (with screenshots) to help you open your first DeFi account. (I’ll be emailing you about this soon to tell you more.)

I promise: The process is easy—really—and requires just a few minutes.

But once that account is open, you will begin earning 8.6% immediately on U.S. dollars, without crypto volatility and without the risk that your principal vaporizes. It’s the safe, first step into the shallow end of DeFi.

Soon enough, you’ll be playing in the deep end with me, and telling all your cocktail party friends how you’re earning 194% a year with Ramp DeFi tokens.

Better yet, your first account means you’re that much better-prepared for the future that’s racing toward us…

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.