Your Income’s in Dollars. Your Expenses Aren’t. That’s a Problem.

Does it matter if your income is denominated in US dollars?

OK, that’s a trick question. If you read my columns regularly, you’ll know that I agree 100% with Jeff that keeping all your wealth in dollar-denominated assets is a bad idea at any time… but especially now, and especially if you’re a digital nomad living abroad.

Folks of my vintage are used to the US dollar being the king of the hill. Because US dollars are the default currency for global trade, everybody wants them… even if they’re not trading with the United States. That creates demand for dollars, which pushes up USD’s value. That allows Americans to import foreign goods at low cost.

And for years, it has allowed expats like me to benefit by earning income in dollars and converting it into a weaker foreign currency for spending purposes.

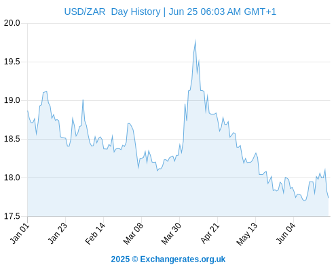

But that’s changing more quickly than anyone expected. For example, since the beginning of this year, the dollar has depreciated versus my home currency, the South African Rand:

At the beginning of the year, I was getting about R18.75 for every dollar I brought into South Africa. Now I’m getting R17.75—a 5.3% decline in my purchasing power. That has a definite impact on my monthly budget.

But imagine if I wanted to transfer a large sum of money, say to purchase property. In fact, I did just that earlier this year. By my reckoning, if I had waited until this week to do that, I would have lost over R350,000 on the transaction. That’s equivalent to a whopping 25% of the purchase price of one of the properties I bought here in Cape Town. (In the event, I managed to transfer the funds in April when the exchange rate temporarily went strongly in favor of the dollar.)

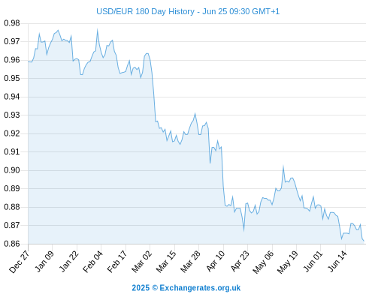

Europe is one of the most popular destinations for digital nomads. Here’s the USD/EUR exchange rate since the beginning of the year:

The dollar’s decline is having a significant impact on anybody earning that currency but spending in euros. Their local purchasing power in the eurozone is down a massive 12%. This isn’t a matter just for digital nomads. Foreign residents whose pension or other passive income is denominated in dollars are also suffering a decline in purchasing power as the currency weakens.

As I said earlier, many Americans abroad have been able to ignore exchange rates for years. The dollar was always strong and typically got even stronger when trouble like the current conflict in the Middle East happened. No more. These days, Americans and others earning dollars are learning a lesson that people in the developing world have known for decades: a weakening currency is a form of personal inflation that can put a serious crimp on your lifestyle.

Fortunately, there are ways you can protect yourself against this.

The first is to do what I do: keep a close eye on exchange rates. I made a massive gain by holding off on converting dollars into rands earlier this year. If you can, hold off transferring dollar earnings or retirement income until the exchange rate moves in your favor.

Second, make sure you have plenty of funds in your foreign bank account. For example, if you’re earning in dollars but spending in euros, try to build up enough euro balances to get you through two or three months of expenses. That way you’re not forced to transfer funds every month even if the exchange rate is terrible.

The third and easiest step is to open an account at a service like Wise or Moneycorp. (Sign up for Moneycorp with International Living’s affiliate link here. Note that IL may receive an affiliate fee—but this won’t affect the exchange rates you get.) I have my professional income paid into a US dollar Wise account. I leave it there, and when the exchange rate is in my favor, I simply transfer to my euro account on that platform. When the EUR/ZAR exchange rate moves in my favor, I then transfer euros into rands. I can then transfer them to my South African bank account as and when needed.

Exchange rates fluctuate over time, and the dollar usually bounces back eventually. But as Jeff and I have explained, there are fundamental changes taking place in the global economy. Investors and financial institutions everywhere in the world are fleeing the dollar, putting downward pressure on its value. That’s likely to continue for the next three or four years at a minimum.

So if you’re planning to live abroad as a digital nomad or pensioner, now is a great time to learn the tricks of the exchange-rate trade!

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.