It’s the bullet you don’t hear.

That’s the one that kills you.

I assume that’s an old military truth. I heard the quote in some movie at some point, so who knows. Whatever the case, that imagery popped into my head this past weekend while I was reading through some statistics.

If you’ve seen the April issue of our monthly publication, the Global Intelligence Letter, you know I have inflation on my mind these days. I think it’s going to cause us a world of economic and financial pain as 2021 progresses and as we move into 2022. It’s why I own gold. It’s why I own silver. It’s why the recommendation in the April issue will see higher stock prices. And I think it’s going to show bitcoin to be an inflationary asset.

So, yeah…that’s coming.

Of course, when I mention this to various friends, they mostly roll their eyes—or the text message equivalent thereof. The last time inflation was anything in America, Gen X (my generation) were kids. The oldest of us were barely tweens. Scooby-Doo and the Pink Panther meant more than inflation.

Over the last 40-plus years, we grew up under a blanket of low to no inflation. Today, after so many decades, this feels like normalcy. Our parents and grandparents, however, have a different recollection. They were the ones watching food prices rise 20% in 1973 and another 12% in 1974, robbing their wallets. They were the ones who saw car loan rates skyrocket to more than 17% in 1981.

Let me put that into a modern context…

If similar, inflationary impacts happened today, average new-car payments would rise by more than $200 a month, while monthly food costs would increase by more than $350 over the next couple of years.

In the wake of COVID, 63% of Americans are now living paycheck-to-paycheck (it was 44% before the pandemic). Imagine that huge population faced an extra $500-per-month burden. What would that do to the economy?

I’ve mentioned in previous writings a phenomenon called Status Quo Bias—our perception as humans that today looks a lot like every yesterday, therefore every tomorrow is pretty much gonna mirror today. It’s logical. Makes sense why we think that way: the number of factors that play on our daily lives is so large, and the number of possible outcomes is so incalculable that we don’t even try to think through the possibilities.

Stick with the status quo and get on with getting on. So much easier that way, really.

But let me toss out a few numbers. Maybe you’ll see what my friends refuse to believe…

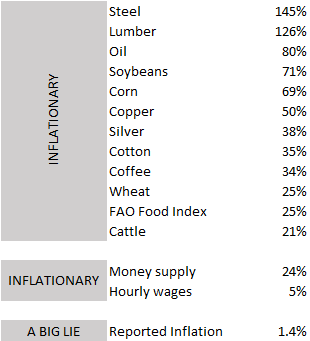

The table shows some of the increases that have occurred between June last year and March.

Let’s see…we have commodity prices on a moonshot. That’s hugely inflationary.

We have money supply and hourly wages rising. Both inflationary.

And we have the government telling us that inflation barely even registers. Hmm…the smell of fish is ripe with this one.

From the government’s propagandistic perspective, of course, 1.4% is legit.

But you have to keep in mind that the Bureau of Labor Statistics, which tracks inflation, likes to jimmy with the calculations through something called “hedonic adjustments.”

Here’s a small example of everything you need to know about this financial chicanery:

Say you bought a new car 10 years ago at what was then the average price of $29,217. And say you’re looking to buy a new car today. You haven’t yet looked at new car prices, but you did happen to see that the Consumer Price Index for new cars is up 6.3% in the last decade.

How shocked are you going to be when you see that the average new car in America today is $37,851—a 29.6% increase in the last decade?

BLS monkey-wrenchers surmise that because a new car today has various improvements over the car from yesteryear, you the consumer are getting more value for money. So, price inflation doesn’t count.

In theory, that might make sense (frankly, it’s ignorant), but we don’t operate in a theoretical world. We operate in a practical world. And in practical terms, your costs are up 29.6% for that average new car—not 6.3%.

If you want to know why the BLS does this, it’s to keep Uncle Sam solvent. Many governmental payment calculations—most notably, annual Social Security adjustments—are predicated on the inflation rate. If the real rate were published, America’s costs would soar and Uncle Sam’s debt would explode way beyond current levels.

If we go back to 1990 and use BLS inflation calculations before statistical voodoo became standard operating procedure, inflation in America is approaching 6% today. It’s up near 10% if we use 1980 calculus. Those are by way of Shadowstats.com, a site that tracks various U.S. economic data based on the methods government used but abandoned when the results grew too inconvenient.

What I’m saying is that inflation is here. Uncle Sam is not going to tell you this, but his silence—let’s call it obfuscation—doesn’t negate reality.

The financial markets are just now beginning to realize the status quo is changing. Bond yields are rising and worry is seeping into Wall Street. Gold prices, meanwhile, are up about 6% in the past year, which oddly (coincidentally?) matches the real inflation rate. Gold will keep rising with inflation.

So will silver.

So will bitcoin, I’m betting.

And, so, it’s time to prepare our defenses. Own gold. Own silver. Own bitcoin.

Don’t let your portfolio suffer the fate of that bullet you don’t hear.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.