Time to Buy This Inflation-Busting Asset?

You could smell it before you could see it.

Spring in south Louisiana as a kid. My buddies and I would be out traipsing through a bayou or a small creek, setting out crawfish nets or chasing snakes… and we’d smell it. That earthy sent of weather on the way.

And in south Louisiana in the spring, “weather on the way” often meant towering thunderstorms with lightning, booming thunder, and sometimes damaging hail stones and tornadoes.

That smell—it has a name actually, petrichor—told us that it was probably best to head home before we got caught in a downpour. Or maybe we didn’t go home—because as a kid covered in mud from a bayou, getting caught in a warm downpour was better than a shower with cold water from a hose at home.

The key point I want you to focus on here is the petrichor serving as an early warning of what’s in the offing… because today’s dispatch it about what’s in the offing.

And what’s in the offing is a substantially higher bitcoin price. (And where bitcoin goes… so goes the rest of the crypto market. That’s why I’m hosting my upcoming Crypto Profits Masterclass. You can still grab a ticket—click here for details.)

The digital petrichor says so…

By “digital petrichor” I mean especially the global supply of money, what’s known as “Global M2.”

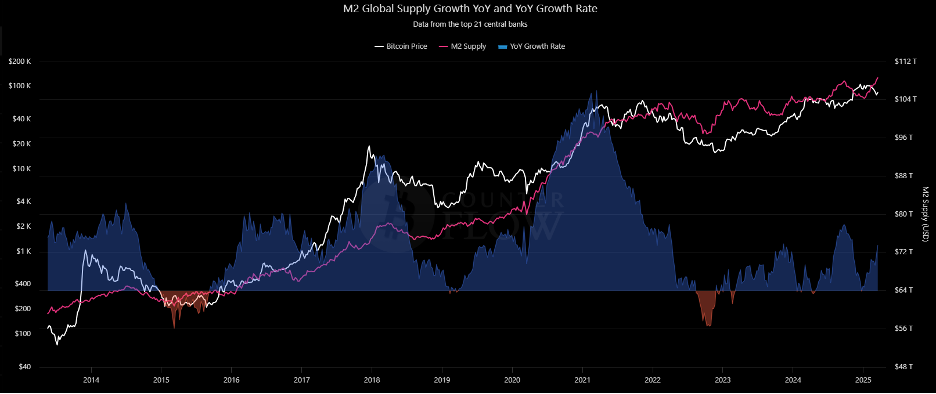

As Global M2 rises… so, too, does bitcoin. You can see that in the graph below. The white line is bitcoin, pink is Global M2, and the blue/orange shaded area is the growth or contraction in Global M2.

We care about this otherwise deeply inside baseball datapoint because bitcoin is an anti-fiat currency/anti-inflation asset, and Global M2 is an indicator that governments are pumping or draining money from the global economy, which in turn is tied to global inflation.

Basically, it’s the idea that the global economy can only produce so many goods and services at a given moment and that if the global money supply increases faster than the ability of the global economy to ramp up increased produce, then we get inflation. More money is chasing roughly the same amount of goods and services.

What our chart shows us is that Global M2 is rising again (the blue there on the far right) but that bitcoin has not yet caught up with that trend (the white line lagging the pink one).

Thing is: Bitcoin always catches up with that trend. It happens on a lagging basis.

Research I’ve seen showed that between 2013 and 2024, bitcoin’s correlation with global money supply is 0.94.

Just so you know, 1.0 is perfect correlation.

So bitcoin is almost perfectly correlated to expansion/contraction in Global M2.

The supply of money goes up… bitcoin goes up. Supply down… bitcoin down.

That 0.06 difference? Short-term lag that results from any number of ephemeral events like, maybe, a tweet about crypto from Trump or some other politician, or a government talking about bitcoin positively or negatively, or some exogenous event like a crypto-exchange failing… or whatever.

Those events are always temporary. They’re always buying opportunities.

So, Global M2 has emerged as “digital petrichor” and right now the smell is telling us to buy because bitcoin will catch up to money supply growth.

Broadly speaking, the lag is anywhere from 60 to about 110 days, depending on all those exogenous events I mentioned.

Though you can’t see it in the chart above, Global M2 began rising again on January 6. A wee bit of basic math would imply that bitcoin should begin to chase the money supply between March 7 and April 26.

We are right in the middle of those bookends.

Meaning now’s the moment to begin allocating some cash to BTC.

Bitcoin’s price is down from all-time highs near $110,000 in late December. As I write this, BTC is bouncing around the $87,000 range after testing lows in the $75,000 range in mid-March.

That seems to be bitcoin’s new base.

I’m now expecting the granddaddy of crypto will begin to march back toward its all-time high, and then exceed it. I suspect we’re going to see BTC in the $150,000 range over the summer, and that $200,000 is possible before Santa comes calling later this year.

Which is why I’ve recently changed up my crypto investing strategy.

For a while now, I’ve been dollar-cost averaging my way into Chainlink every week. (Chainlink pulls analog, real-world data onto the blockchain that allows smart contracts to function, and smart contracts are rapidly emerging as one of the most important sectors in blockchain technology.)

Instead, my weekly cash is now flowing into bitcoin through an auto-invest function that Coinbase offers. I’ve also made some trades that moved me out of certain other crypto and into bitcoin.

(To learn more of the crypto strategies I’m pursuing right now—and how to structure an entire crypto portfolio… you won’t want to miss my upcoming Crypto Profits Masterclass.)

The tailwinds blowing in favor of bitcoin are just too powerful to ignore. Countries, cities, various US states are all talking about—or have approved—bitcoin reserve funds. The International Monetary Fund is adding bitcoin to its reserves, and now the US government is looking to purposefully devalue the US dollar on the global stage as a way to potentially rebuild America’s manufacturing sector.

Plus, we have Global M2 on the rise again as countries pump more and more local currency into their economies.

All of that is extremely bullish for bitcoin and for those who are buyers today.

I mean, you can just smell the profits in the air.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.