Protect Your Future Finances—Outside the US Financial System.

If I had a nickel for every nickel I don’t have… the wealth I’d own!

Nonsensical. I know.

Nevertheless, that was the first thought that popped into my mind when I read that Donald Trump had signed an executive order to build an American sovereign wealth fund.

Don’t get me wrong—it’s a fantastic idea.

Well, maybe fantastical is more accurate.

Norway, China, Singapore, the UAE… a whole slew of countries operate sovereign wealth funds. Many of them are gargantuan. Norway’s fund now controls roughly $1.75 trillion. China is just behind at nearly $1.35 trillion.

Thing is, those countries have the wealth to funnel into their funds.

The US, alas, does not have such wealth.

We have debt. And therein lies the rub—as well as the reason for my dispatch today.

First, this has nothing to do with Trump. His executive order, well-meaning as it is, simply serves as the fodder that allows me to address a problem America faces that is so much bigger than the lack of a sovereign wealth fund.

Truth is, we should have had a sovereign wealth fund in place eons ago.

All the oil and natural gas and minerals that companies have extracted from American lands… That’s how Norway built its fund—from all the oil and gas the country produced over the decades.

It’s how Alaska sends its residents an annual “dividend” check—$1,702 last year. Alaskan lawmakers in 1976 wisely legislated that some part of the state’s oil wealth should go into a permanent fund that benefits all Alaskans, not just the companies pulling energy resources out of the state.

But instead of planning for America’s future, every American president and member of Congress going back to at least the Reagan era has focused on pillaging Uncle Sam’s assets and his wealth to:

- Fund boondoggles and pork-barrel projects that do little to improve the country as a whole.

- Buy votes through payoffs to favored constituencies, based on borrowing more and more money.

Again, not Trump’s fault. Well, partly his fault, given that his first term added an additional $7.8 trillion to Sammy’s mountain of debt, at the time a 33% increase.

Neither here nor there, though. Because the real point is that the US talking about starting a sovereign wealth fund in the country’s current fiscal state is like a family insisting it’s going to start saving for the future when its debt load is so large that it has to borrow money every month just to afford to keep the lights on.

In a word: puzzling.

Facts to keep in mind:

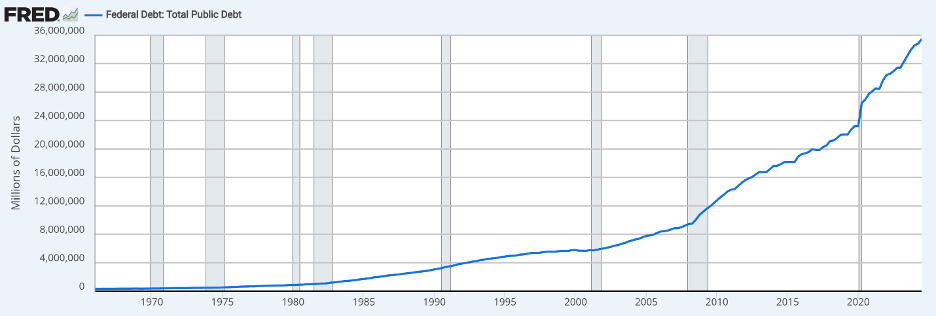

- America currently has $36.4 trillion in sovereign debt, about 123% of the country’s GDP (a crazy high number).

- Debt is so large that the country now pays more than $1 trillion annually in interest payments on that debt. That’s about 15% of the federal budget, the largest line item excluding Social Security and Medicare.

- The US borrows money to make interest payments on the money it previously borrowed. There’s no end in sight to this financially debilitating trend.

- The non-partisan Congressional Budget Office estimates America will overspend its budget in 2025 by $1.9 trillion, or 25% of the original budget, meaning America’s debt will quickly approach $40 trillion.

- America hasn’t run a budget surplus since Bill Clinton accomplished it in 1999.

So, riddle me this: Where does America find the “wealth” to pump into this proposed sovereign wealth fund? It’s certainly not going to come from daily operations, since for every $1 it costs to run the country, Congress is borrowing 32 cents.

We could sell off assets like, say, sell American parkland to a company like Disney. That would raise oodles of money up front that we could funnel into a sovereign wealth fund. And then Disney would pay the US a portion of all parkland revenues every year that would also funnel into the fund. (And if you did follow such a strategy, wouldn’t you use the proceeds to, say, pay down the debt before investing? Seems a better return.)

But anyway, let’s be real: The biggest problem is Congress.

America could sell off every national asset. It could funnel a fat stream of money into a sovereign wealth fund from oil, gas, and mineral extraction.

But would it even matter when you have the DC Clown Show with its hands in the till 24/7/365?

Look what politicians have done to Social Security. They’ve robbed it blind over the years and left behind a bunch of pointless and worthless IOUs. And every Congress since about forever has tried to negate those IOUs by insisting that the Social Security system they broke is—clutch my pearls!—broken and needs to be scrapped, privatized, or benefits radically cut.

Does anyone really think that an American political body would not raid a sovereign wealth fund packed with trillions of dollars? Congress-folk are not smarter than a fifth grader. And they have the willpower of a three-year-old left alone with a plate of Oreos.

Snowballs have a greater chance of surviving a day in hell than a dollar bill does making it into a sovereign wealth fund without being snatched up by Congress for some janky vote-buying scheme.

All of this highlights the biggest problem of all: America is broken.

Sad to say.

True, nonetheless.

America’s fiscal incontinence not only precludes a sovereign wealth fund, it means that the country will have to face a financial reckoning sooner rather than later.

Which, I guess, gets to the real point of today’s dispatch here at the bottom. Follow Trump’s instinct: Build your own sovereign wealth fund.

Buy crisis-protection assets. You know my faves: Gold. Swiss francs. Bitcoin.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.