Here’s What I’m Doing to Profit Right Now…

I’m sitting here trying to think… What is the cryptocurrency version of “Make hay while the sun shines”?

I got stuck on “Stack sats while the bitcoin shines,” so I’m going with that. “Sats” (“satoshis”), by the way, are to bitcoin what pennies are to the dollar.

Bitcoin is in a post-election euphoria for various reasons, but the primary one is that, in theory, prez-elect Trump is pro-bitcoin and wants to create a bitcoin reserve fund for America. He’s almost certain to dump anti-crypto SEC Chairman Gary Gensler for someone who is pro-crypto.

Aside from bitcoin rapidly racing higher—it has set new all-time-highs north of $89,000 and is closing in on the psychologically massive $100,000 level—the exuberance in crypto today means there’s lots of profit and income opportunities available.

Here’s what I mean…

- Last Wednesday, the day after the election, I funded a crypto-trading account with $1,000. By Saturday, it stood at $1,928.

- I put about $6,000 into what I will euphemistically call a “cryptocurrency kiosk account” so that I can be the bank effecting trading between buyers and sellers of two particular cryptocurrencies. I earned $35.79 in less than a day—which doesn’t sound like much but equates to more than $13,000, or 118% annual return, and with minimal risk relative to crypto’s crazy volatility.

To be clear, I am not suggesting you rush out and start day-trading crypto. Lots of risk in that—though I will also say that the rewards are ridiculous for those who want to learn how to trade. I saw an acquaintance’s account last Saturday and the profits for a single day’s trading exceeded $31,200.

I’m also not saying you should launch Harold & Maude’s Crypto Exchange Kiosk.

Both of those strategies have a big learning curve. (Note: I will be writing in the next Frontier Fortunes[BM1] issue about my “cryptocurrency kiosk account.” It really is a relatively low-risk way to generate nice returns from crypto without having to do much of anything beyond pairing two crypto in a single transaction, and allowing traders to trade back and forth between those two crypto. You simply collect the fee for providing the necessary liquidity the traders need.)

Instead, the point of today’s dispatch is to note that, well, now really is the time to stack sats while bitcoin is shining.

Crypto markets race to extreme and unlikely highs… and then something happens and momentum drains quickly, like water from a tub. Right now is the moment to chase profits in crypto as bitcoin closes in on $100,000.

As I noted, that’s a psychological level that will be historic.

BTC at $100k! will be headlines all over the world. And those kinds of headlines prompt the masses to action. It was the same back in the days of Internet 1.0. Starting in the mid-’90s, FOMO, or “fear of missing out,” set in, and investors raced to own any stock with a “.com” in the name.

Before the bubble burst in 2000, early investors had made beaucoup stacks of greenbacks off the FOMO of latecomers.

That’s what’s going to happen in crypto.

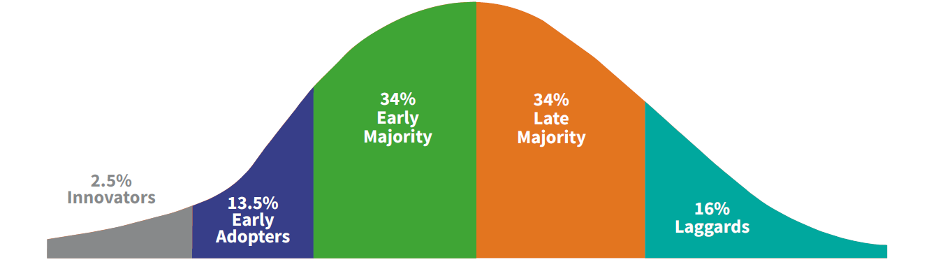

There is a bell curve to tech adoption that starts with innovators and early adopters, and then progresses through early majority, late majority, and finally the laggards.

Right now, the innovators are sitting on big, big gains.

If you were buying bitcoin, Ethereum, and Solana back when I recommended my readers wade into crypto at the tail end of Crypto Winter in January 2023, you are an innovator. If you’ve been buying across 2024, you are an early adopter.

The people buying now are the earliest part of the early majority. Once BTC crosses $100k, the rest of the early majority are going to rush in, followed by the late majority, after they figure out how to open and fund crypto accounts, and where to go to trade bitcoin.

After that, they’re going to go hunting for crypto-investment strategies beyond buy-and-hold. Same thing happened in the early dot-com days.

Average investors saw the huge wealth early adopters had collected, and they wanted a piece of that too. But, of course, a stock that had moved 1,000% or more typically didn’t have another 1,000% gain in it.

Still, they wanted more than simply holding Pets.com… they wanted to super-size their profit potential. Which is where we saw the rise of day-trading and options trading among people who, until that moment, had no clue what either of those were.

Same thing will happen this time around too.

And the path from here to there means big profits for those who are buying bitcoin and Ethereum and Solana and a host of other crypto right now. Back in early October, I wrote to my Frontier Fortunes subscribers [BM1] about why the Solana blockchain was in position to become one of the most important blockchains in commerce, and I recommended they buy a particular list of seven crypto that trade on the Solana network.

Today, a month and four days later, every one of those positions is up between 28.2% and 141%.

The early adopters are making bank!

And the bank is only going to get bigger as bitcoin pushes past $100,000.

The crypto market is giving us an opportunity to build some abundance into our lives. Exploit the moment. If you don’t understand the crypto market, invest some time to learn the basics—how to trade, where to trade, how to use a “browser wallet.”

When you’re comfy with that, learn some of the less risky income strategies like my “cryptocurrency kiosk account” which I’ll be writing about in Frontier Fortunes soon, and which is officially known as “dynamic liquidity market making.”

What I’m saying is, stack sats while the bitcoin shines.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.