Trump’s Plan to Solve the National Debt With Crypto.

Bitcoin $100,000.

Well, more accurately, it’s bitcoin $103,249.98 as I write this.

For several years now, I’ve written that six-figure bitcoin was coming, and here we are.

Now for my next magic trick, I’m going to say, “Bitcoin Infinite.”

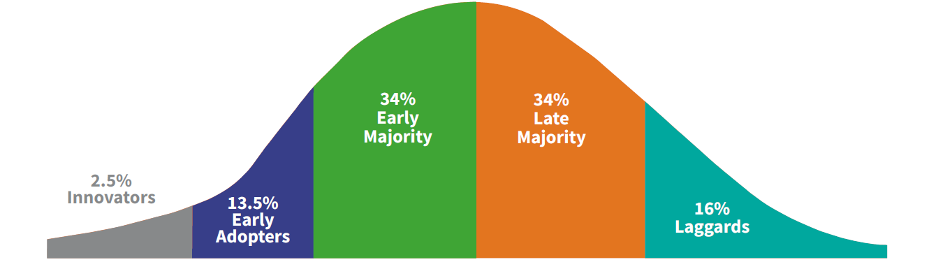

That’s what today’s dispatch is all about… If you’re a long-time Field Notes reader, you’ll understand when I say that I like to live on the edge of the bell curve.

Specifically, I like hanging out over on the far left side where, in technology-adoption terms, the “innovators” congregate.

In my terms, I see that side more as the home of the “disruptors”—the people thinking big thoughts that most folks in society aren’t comfortable with (yet) or which they balk at or mock… or, if they’re a polite Southerner, they’ll just say, “Bless your heart, El Jefe.”

But over here along the left tail of the bell curve is where I see the seeds of Bitcoin Infinite.

It all centers on Donald Trump…

Back during his presidential campaign, DJT told Fox News’ Maria Bartiromo that, “Who knows—maybe we’ll pay off our $35 trillion dollar [national debt], hand them a little crypto check, right? We’ll hand them a little bitcoin and wipe away our $35 trillion.”

Most commentators took that as a bit of throw-away comment. Just another example of Trump tossing a bone to the crypto bros, pandering for their vote.

At first, I thought that too. But then, after some reflection, I began to see the idea differently.

For several years now, I’ve been writing about the idea that bitcoin, like gold before it, could very well be the core of a solution that saves the US dollar from the indignity of a debt spiral.

I won’t go into America’s debt problems. You likely already know that there’s no plausible, traditional way to repay $35 trillion in debt, and that debt servicing costs of $1.4 trillion are now consuming about 15% of Uncle Sam’s annual budget, an inordinately large number.

Instead, I want to share with you my left-tail theory of The Donald’s “We’ll hand them a little bitcoin” comment.

Let’s start back in 1933. FDR confiscates gold. Why? To save a troubled US dollar, which at the time was backed by gold. The Federal Reserve Act, which created the Fed in 1913, required that the central bank back each dollar with at least 40% gold. But by the late 1920s, the Fed had effectively reached its limit. Based on the quantity of gold it had on hand, the Fed had no way to issue more dollars to help save the US economy amid the ongoing impacts of the Great Depression.

So, FDR confiscated gold to fatten the Fed’s horde, and the US then repriced gold 69% higher. In a pen stroke, the fiscal crisis choking America vanished.

Jump to the 1970s. Nixon has abolished the gold standard.

Henry Kissinger attended at a meeting in Europe where he announced oil prices were going up 400%, a way to expand the oil market so that it would be large enough to back US deficits that were growing ever larger. Lots of historians blame OPEC for that price increase. More likely that was America replacing the gold-backed dollar with the petrodollar that we’ve had ever since.

Now here we are—an age when gold is no longer seen as a viable standard to back currencies, when oil is on its way out because of growing green energy demands, and when America has accumulated vast and troublesome debts.

What to do?

Tie the dollar to bitcoin.

Interestingly, Trump spoke at a bitcoin conference earlier this year and referred to bitcoin as “the new oil.” And he wants to build a strategic bitcoin reserve like the US Strategic Petroleum Reserve.

Imagine this: Trump succeeds in building the Bitcoin Strategic Reserve Fund that he says he will pursue. And imagine he successfully loads it with 1 million bitcoin. At today’s bitcoin price, that’s $100 billion dollars.

When bitcoin reaches a price of $1 million, the reserve is worth $1 trillion.

Keep adding zeros to the bitcoin price and the value of the reserve grows ever larger.

But what would cause new zeros to appear?

Mass adoption.

We’re already seeing that on a small scale with the rise of bitcoin exchange-traded funds that have seen record-setting inflows from Main Street investors as well as institutional investors who had previously shunned crypto, but are now building large positions in bitcoin.

But true mass adoption won’t come until there’s a truly compelling reason, i.e. Mom-and-Pop Main Street investors feel they have no other choice but to own bitcoin as a way to protect their financial life.

Which brings us to the dark part of my thesis.

For bitcoin to save the US from death-by-debt, America’s monetary bureaucracy would need to allow the dollar to effectively collapse globally. They’d need to orchestrate a reason for the dollar to lose its reserve currency status, which would cause the buck to plunge like a brick tossed into a lake.

I can think of a few causes, but none more obvious than a debt-ceiling fight in which Republicans, under Trump’s guidance, finally sit on their hands and refuse to play ball with Democrats.

They’d allow the US to default on its debt payments, likely over an extended period of months, which would create chaos in global financial markets and see countries the world over collectively decide that the US dollar is no longer a safe haven.

Hyperinflation would scream through the US economy. Family wallets would be wiped out. Savings would dwindle to nothing. Paper assets would dive in value.

But bitcoin?

It would soar in value relative to an ever-declining dollar.

At some point, the value of the bitcoin in America’s strategic reserve would buy so many dollars that the US could effectively wipe out most or all of its existing debt.

That period from crisis to solution would be exceedingly painful for traditional savers globally. Economies would retreat. It would be Great Depression 2.0, though its span will last just a few years rather than the decade that the OG Great Depression required back in the 1930s.

The US would emerge—likely in the early 2030s—as a far stronger, debt-free nation, with a new US dollar tied explicitly to bitcoin, or maybe even a basket of major cryptocurrencies, and possibly even gold (assuming America’s gold reserves are real).

Like I said, this is a dark scenario (though it has a very bright ending). But that’s what it’s like over on the left tail. The theories are very often dark; theories people don’t want to consider as remotely possible.

But awakenings require you to have been in the dark first, before opening your eyes.

A darkness is likely coming. But as I’ve been saying for a few years now, bitcoin will be the light that destroys the darkness… That’s one of the reasons I routinely tell everyone who will listen that they need bitcoin in their portfolio.

Crazy as all this might sound, we’re now moving into an era where a president-elect is pro-crypto, and has outwardly stated many times that he sees bitcoin as a solution to America’s problem.

I’d be listening.

And acting.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.