Here’s How We Get There…

I’m old enough to remember when a billion dollars was real money.

Today?

Pfffft. Piddling pocket change.

No, really—pocket change.

A billion dollars relative to America’s national debt that late last year crossed $36 trillion for the first time… is equivalent to less than $0.28 on a $10,000 charge.

Pocket change in the grand scheme of death by a trillion paper-dollar cuts.

But, of course, we all already know that America’s debt has gone all Fonzie Fonzarelli on us (i.e., jumped the shark). So why share news of the obvious?

Well, nothing ever happens in a vacuum, but vacuums do make a giant, sucking sound… and the sucking sound we’re soon to hear will be financial markets around the world gasping as central bankers begin pumping more money into their economies to keep them propped up a little while longer.

Which, honestly, sounds like a very boring topic to read about…

But keep reading. There’s money to be made for those who see how this dot connects to that one…

That other dot, in this case, is bitcoin.

And in this case, I mean bitcoin specifically, rather than crypto in general.

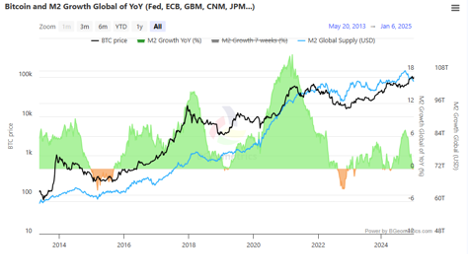

Before we start connecting those dots, however, let me share a chart that you need to see. It will help make the dot-connecting clear.

There’s a lot going on here, and some of the numbers are teensy tiny. So let me simplify:

The black line is bitcoin’s price going back to 2014.

The blue line is the global M2 money supply… meaning the supply of cash, savings and checking accounts, and the equivalent of certificates of deposit in big economies like the US, the UK, the Eurozone, Japan, Canada, etc.

The green/orange tracks the year-over-year change in the growth/contraction of the global M2 money supply.

Fan-freakin-tabulous, El Jefe—now tell me what it means before I doze off.

It means that as the M2 money supply expands and contracts, bitcoin follows along very closely. Like a shadow, for the most part.

Again, this is year-over-year data. So on a daily or weekly basis, the correlation can weaken. But over the long haul, BTC basically follows global M2 money supply.

And with good reason.

As I noted, M2 is the supply of money to which all of us have access. If money supply is rising, there’s more money in the system that investors can use to, well, invest. And a lot of that money to invest lands in bitcoin, which pushes prices higher. It’s that simple supply/demand calculus that holds: More money chasing the same amount of Item X tends to push up the value of Item X.

When M2 is shrinking, well, the opposite happens. Money tends to come out of bitcoin, and bitcoin’s price falls.

And why all of this is important is because of these facts:

- China’s economy is deep in the dookie. Stimulus is highly likely this year.

- Market interest rates in the Eurozone—the rates the financial markets have set, not the rates the European Central Bank sets—are coming down, which implies a perceived worsening of the economic outlook in much of Europe. Stimulus likely.

- The UK money supply (not associated with the Eurozone) is rising.

- German GDP is slowing.

- Darker economic skies are also emerging for Japan.

The US financial markets are focused (too) intently on what the Fed’s up to these days, and sudden concerns that just maybe the Fed won’t cut rates in 2025. But by focusing on the Fed, the market is overlooking the rest of the world.

And the rest of the world says the M2 money supply is quite likely to rise this year to stave off slowing economies.

Estimates I’ve seen suggest that large economies could inject as much as $20 trillion into the money supply. As I write this, global M2 is somewhere in the $107 trillion to $110 trillion range… meaning a $20 trillion injection is not small beer.

If that happens, and if we take it on faith that BTC benefits from increasing global M2—as the chart shows us—then bitcoin is likely to climb toward $150,000 this year, and possibly a good bit higher.

And how do I get there?

Math.

There are 21 million bitcoin.

Let’s assume bitcoin snarfs up 5% of that $20 trillion M2 injection. That’s $1 trillion added onto bitcoin’s market cap. Spread a trilly across 21 million coins, and you get $47,600 per coin. BTC right now is about $95,000. Tack on vaguely $50k and you’re approaching a $150,000 price tag.

If 10% of the $20 trillion M2 increase found its way into bitcoin (not a wild assumption, given rocketing demand for bitcoin among institutional investors these days), BTC would effectively double today’s price and approach $200,000 before 2025 ends.

In short: The world’s big economies will dump a boatload of money into the global economy this year, and some portion of that will flow into bitcoin… causing bitcoin to set new, all-time highs in 2025 that are well above $100,000.

A trillion here, a trillion there, pretty soon you’re a bitcoin millionaire… assuming you own bitcoin.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.