Lock-In Solid Yields Before The Fed Cuts Rates

There’s more than one way to skin an interest-rate cut.

Which doesn’t really make a whole lot of sense, I know. But hopefully you get where we’re going today…

Where we’re going is an opportunity to lock-in solid yield now—before the Fed begins cutting interest rates.

Sure, we can chase dividends—I wrote about that in yesterday’s dispatch—and we can lock-in some decent rates with certificates of deposit at certain banks. But there’s another income opportunity that lots of investors tend to overlook: preferred stock.

Now, “preferreds,” as they’re called, are a funky little monkey.

They operate partly like shares of stock and partly like bonds. You don’t really find a lot of mainstream media talking about preferreds, and with good reason: These stocks are never going to pop in price like, say, shares of Nvidia or Apple or whatever.

Main Street investors largely overlook preferreds. Maybe it’s lack of knowledge. Maybe lack of exposure. Whatever the case, preferreds are under-represented in most portfolios.

Yet, they represent a solid opportunity to bag big yield with relatively minimal risk.

So, I am using today’s dispatch to talk about preferreds because when the Fed starts cutting rates again (as it will this year) that will have investors on the hunt for yield once again. They’re going to start with common stocks, as well as real estate investment trusts (REITs) and master limited partnerships that trade on Wall Street.

And then they’re going to migrate over to preferred stocks…

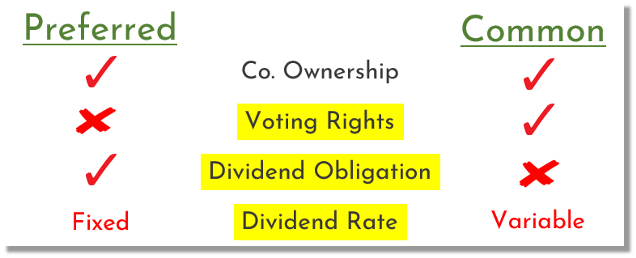

First, let’s compare preferred shares to common shares, so you know what you’re getting—and what you’re not getting.

I’m stealing this chart from the upcoming Retirement Income Masterclass I’m holding because, well, I think it does a good job of explaining the key differences between preferred and common stock:

Let’s go through this.

Both preferred and common stock represent pro-rata ownership of the underlying company.

However, preferred shareholders have no say in how the company is run. They have no voting rights. Only common shareholders get to vote on CEO compensation, merger plans, and whatnot.

In exchange for that, preferred shareholders benefit from a dividend obligation that common shareholders do not have. In short: If you own preferred shares, you are all but guaranteed to receive a dividend, while common shareholders are guaranteed nothing of the sort.

That preferred dividend, though, is fixed. It’s set in stone. You will always receive the exact same amount every quarter, no matter how big the company grows. When common shareholders do receive a dividend, that dividend payment is variable, meaning it can rise and fall based on the company’s underlying earnings.

So, which is better?

Well, that depends on your goals as an investor.

If growth in principal is your primary goal, then you want the common stock. That share will rise as the company’s fortunes improve. There’s zero guarantee you will collect a dividend along the way, but if and when a dividend exists, it will generally rise alongside the company’s growth.

If, however, you’re a retiree and consistent, guaranteed income is your primary goal and you’re not much concerned about stock-price growth, then I’d argue preferred shares are the way to go. You’re (generally) guaranteed a dividend, that dividend payment is fixed (so you can plan your monthly income and spending), and you can sleep well at night because the risk profile for preferreds is usually quite tame.

I say that because Wall Street largely treats preferred stock as something like a hybrid bond.

The Street knows that a preferred dividend is never going to change. In that way, it’s exactly like a bond’s interest payment. And so, the price of a preferred share typically never moves too far away from the so-called “par value,” the value at which the preferred was issued and at which the company can redeem the shares at some point.

I’m going to use as an example a preferred stock we have inside my Global Intelligence portfolio. Tsako Energy Navigation, Preferred F shares. Tsakos operates a fleet of tankers ferrying oil and liquefied natural gas around the world.

Disregard the big dip. That’s a COVID-19 fluke. Instead, pay attention to the red line. That’s the $25 mark—Tsakos’ par value. In the aftermath of COVID—meaning a more normal world—Tsakos F shares have largely hung around the $25 mark.

Recently, they’ve begun nudging above that level because the dividend is so plump: $2.38 per share, per year, or a yield of more than 9%.

At Global Intel, we’ve owned Tsakos for just over two years. In that time, we’ve collected more than $5.34 per share in dividends, meaning we’ve already recouped more than 22% of our original purchase price in dividend payments alone.

Plus, we grabbed the shares at $23.89 each, slightly below par value. The upshot there is that if/when Tsakos redeems its Preferred F shares, we’re going to capture $1.11 in capital gains, or another 4.6% on top of the dividends we continue to hoover up every quarter.

Now, I’m not telling you to go buy Tsakos right now. It’s already trading above par and I’d rather buy preferreds below par to potentially benefit from any capital gains that might accrue.

I’m simply using Tsakos as an example of what you want to find in preferred shares: A solid company, in a necessary industry (shipping oil and gas is arguably one of the most important industries in our modern world), paying a yield well above 5% (always my personal cut off), and trading below par (for the capital gains potential).

Find a preferred like that, and you will find a very stable source of high-yield income—in a falling interest-rate environment—that lets you sleep well at night.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.