The Day of Harvest Is Coming…

“When someone shows you who they are,

believe them the first time.”

– Maya Angelou

The world’s central bankers are showing us who they are. Believe them.

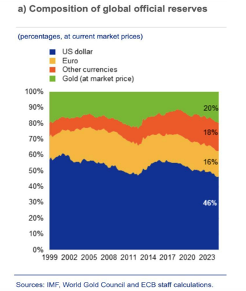

Gold has now overtaken the euro as the #2 most-widely held reserve asset inside central banks around the world. The dollar is still king of the hill (for now) but it’s primacy is in decline.

Gold on the other hand is on the rise.

Here’s a visualization of the trade, courtesy of the European Central Bank. (Despite the timeline cutting off at 2023, the data runs through early 2025.)

Back in the late 2010s, gold represented about 12% of central bank holdings and the dollar roughly 60%. Now, gold is up eight percentage points while the dollar is down nearly 14 percentage points.

For me to tell you overtly that there is a message in that is like a priest telling you overtly that there’s a message in his Sunday homily.

The message (and I am sure you figured this out already) is: BUY GOLD!!!!

I know. I know. That’s a message I remind you about on repeat. You’re probably tired of hearing it.

(But you may be surprised by all the different ways I recommend you own gold… and that’s why I’m hosting a special FREE workshop next week.)

If you do not yet own any gold in your life, then you need to stick around and listen to El Jefe’s Homily-of-the-Day.

Today, my lambs, we turn to Proverbs 6:6-8:

Go to the ant, O sluggard; consider her ways, and be wise. The ant has no commander, no overseer, no ruler, yet she stores her food in the summer, gathering it for the day of harvest.

Can I get an “Amen”?

We can assume that Aesop stole/borrowed his story of the ant and grasshopper from King Solomon, who’s credited with writing most the Bible’s Proverbs chapter. If not, well, my point today still remains—that those who are wise and diligent enough to prepare for tomorrow are the ones who shall reap their rewards on the day of harvest.

And the day of harvest is coming.

Which is why central bankers are prepping like doomsdayers laying in a year’s worth of freeze-dried chili in their end-of-the-world bunker.

See, central bankers are not investors.

That’s not their calling.

They’re bureaucrats charged with managing a country’s monetary policy and doing what they can to maintain economic stability.

They do boring financial work. They’re not trying to gauge whether Walmart will beat Wall Street expectations. They’re trying to figure out what the future holds for local and global economies, and how that plays through the economic, financial, and banking system they’re charged with minding.

So when they’re sucking up gold like a Hoover without an off switch, they’re sending a message that they’re prepping for bad news ahead. Bad news that will destroy fiat currencies backed by nothing but air and what are effectively “thoughts and prayers.”

Central bankers see what we don’t… which is actually kinda scary.

I mean, I see a lot!

I’m routinely connecting dots no one else is really paying attention to, and too often those connections are accurate. And I tell you all the time about the bad storms I see a’rising.

But central bankers see more. They have deeper insights than even El Jefe can muster because El Jefe is not privy to all the reams of private data and all the teams of analysts that central bankers corral.

My view of the future is sad enough. But based on the historic quantity of gold that central bankers are buying, their view is downright apocalyptic.

Per Reuters, from earlier this month:

Central banks worldwide are on track to buy 1,000 metric tons of gold in 2025, which would be their fourth year of massive purchases as they diversify reserves from dollar-denominated assets into bullion, consultancy Metals Focus said.

The fact to remember is that central banks are not investors. They don’t buy gold because they’re betting the price goes up. They don’t care about an asset’s nominal price.

They buy and hold gold because they’re worried that global currency values are going to collapse. Gold allows them to protect the economies over which they lord.

If the local currency plunges, the value of gold in terms of fiat money will rise and offset all or some of the local currency’s loss of value. Or the US dollar’s loss of value.

See, most countries around the world hold a boatload of dollars because of that whole “reserve currency” thing and the fact that countries need dollars to facilitate their trade with the world (that, by the way, is changing as the world de-dollarizes).

As the dollar’s value sinks (or potentially collapses)—it’s plunged 11% so far this year—the price of gold is going to soar. I fully expect gold, now at about $3,400 per ounce, will see $10k before it ever again sees $1k.

Central banks are prepping for that likelihood. They keep buying more and more gold by selling off more and more dollars.

I’ve been doing the same, though I will note that my buying has largely been in the gold-mining and gold-streaming sectors in a retirement account, since I already own a bunch of physical gold. (To see how you can invest in gold like I do… and even get a regular income from gold… tune into my upcoming Gold Income Workshop. You can sign up FREE right here.)

I will end today’s homily by returning to Proverbs, this time 24:27:f

Prepare your work outside, get everything ready for yourself in the field, and after that build your house.

I wonder if central bankers have been reading King Solomon’s Bible verses?

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.