Will Americans Keep Digging This Hole Deeper Into 2024?

And now this blast from the past:

“The economist community was flabbergasted last week when the latest retail sales data shows consumer spending jumped 4%, “smashing expectations” in this inflationary age, or so claims a CNBC headline.

Those expectations wrongly supposed that inflation would very likely curtail the consumer’s willingness to spend, which paired with the Federal Reserve’s aggressive rate hikes would lead to a slowing economy … a reduction in inflation … and, thus, a return to a Goldilocks existence.

Alas, not so much.

Spending continues to run hot.

So hot, in fact, that consumer debt has now hit an all-time high of $16.9 trillion—about $51,000 of debt per American.

A big reason for the increase: Consumers are loading up spending on their credit cards…”

Here in this third installment of “What did Jeff write earlier this year, and was he right,” I take us back to those words from an early February Field Notes dispatch. At that time, I was pointing out that economists and the Fed had, again, misread the tenor of consumer society.

There was simply no chance consumers were going to back off their buying binge because:

- A. They’re smart and they knew inflation was the real deal, so they were willingly trading a paper asset (dollars) at risk of deflating for real assets that bring utility and/or happiness to their lives, and;

- B. In a world where inflation pushed up prices way faster than already underwhelming family incomes were growing, consumers had no choice but to pile ever more debt onto their credit cards just to get by, or to at least keep up the appearance of a middle-class life.

So, how did that play out?

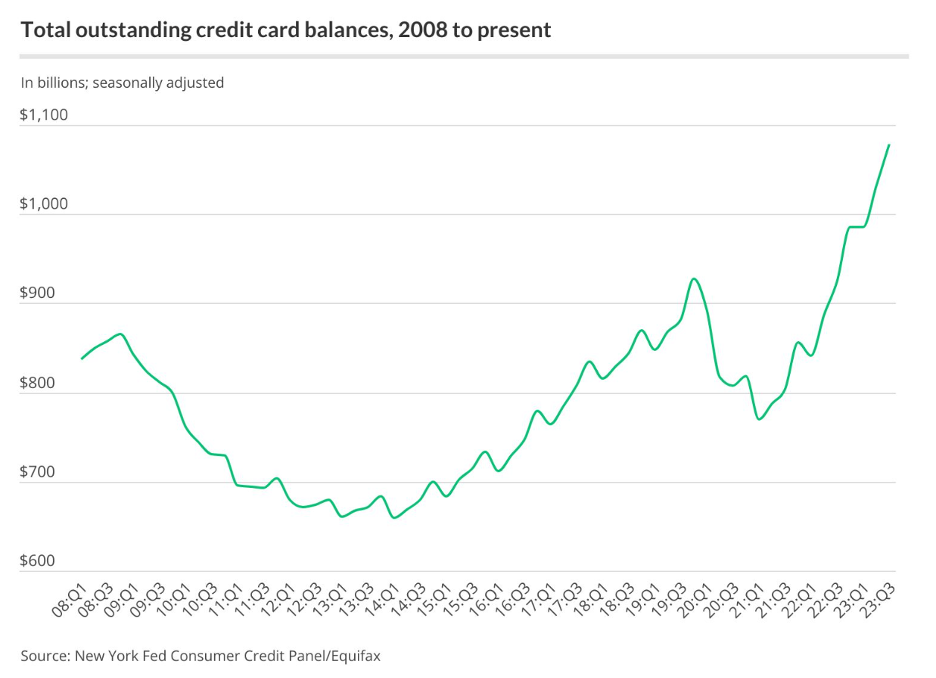

Well, we started 2023 with American households collectively owning just under $1 trillion in outstanding credit-card debt. We end the year with outstanding credit-card debt approaching $1.1 trillion. So, reliance on debt has increased.

Gonna notch that up as a win.

Although, to be fair, it’s a loss for Americans as a whole.

The chart below from the New York Federal Reserve’s quarterly Consumer Credit Panel shows plainly the pain American families are feeling.

Look at the post-COVID spike on the far right.

Americans used the pandemic to sharply pay down their credit cards. They had all kinds of government stimulus money flowing in, and many had stay-at-home jobs that saw their expenses for commuting, office lunches, new office attire, etc. fall away, leaving extra cash at the end of the month to pay down credit cards.

And then COVID faded, stimulus payments stopped, return-to-work orders began flowing in… and suddenly reliance on debt shot up at pace the U.S. has never before seen. A big part of that is obviously the inflation that settled over the economy.

But even Mastercard and American Express have their limits.

Consumers cannot keep paying for their life with plastic because balances ultimately grow so large that paychecks can’t afford the minimum due, and credit-card companies start cancelling cards. Already, personal bankruptcies in the first half of 2023 were up 23% from a year earlier.

Here’s my concern as we head into 2024: High interest rates will finally impact the consumer.

Bankrate.com recently reported that the average credit card now carries a 28.93% interest rate on unpaid balances. That’s not only usurious, it’s an historic high.

Back in 2020, the average American carried a credit-card balance of $6,600. The average credit-card interest rate was 25%. Thus, the typical monthly minimum payment was $203, with a full pay-off value of $13,070 over 26.25 years (assuming one makes just the minimum payment every month).

Here in late 2023, the average American now carries credit-card debt of $8,000. With average interest rates right at 29%, the monthly minimum has shot up to $273, and the full pay-off is now $18,600 over more than 28 years.

The hole is getting deeper and there’s no ladder in sight.

Seventy bucks a month might not sound like much. But it’s about 2% of the typical American’s after-tax wages. Toss in higher food prices, higher utility costs, higher housing and rental prices, higher prices for cars, medical care, and everything else, and 70 bucks suddenly imposes a much more real impact on a family.

As such, 2024 seems like it could very well be a year when consumer spending finally slows out of sheer necessity. Which would be just another factor tipping the economy toward recession.

Of course, if the Fed slashes rates by more than a little, asset markets are going to boom, particularly crypto. That will enliven consumer sentiment and put lots of money in more people’s pockets… which would then see credit-card balances begin to fall again, even as spending keeps apace.

What I’m saying is that the Fed’s early moves in 2024 will tell us where we’re going. Stay tuned…

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.