Why Gold Is Defying the Textbook—and What It’s Telling Us.

In the classic movie Young Frankenstein, the good doctor’s henchman, Igor, delivers a brain for Frankenstein’s monster which has come from, Igor claims, someone called “Abby Normal”… Poor Igor has instead, of course, brought the monster an “abnormal” brain—leading to all sorts of hijinx…

Today, we’re going to meet young “Abby Normal”—but these days she’s found not in the company of Dr. Frankenstein but lurking in the bond and gold markets…

As much as I love to write colorfully descriptive paragraphs to entertain you with my take on the world, sometimes a chart is worth a thousand analogies and metaphors.

And, so, I give you El Jefe’s Chart o’ the Day…

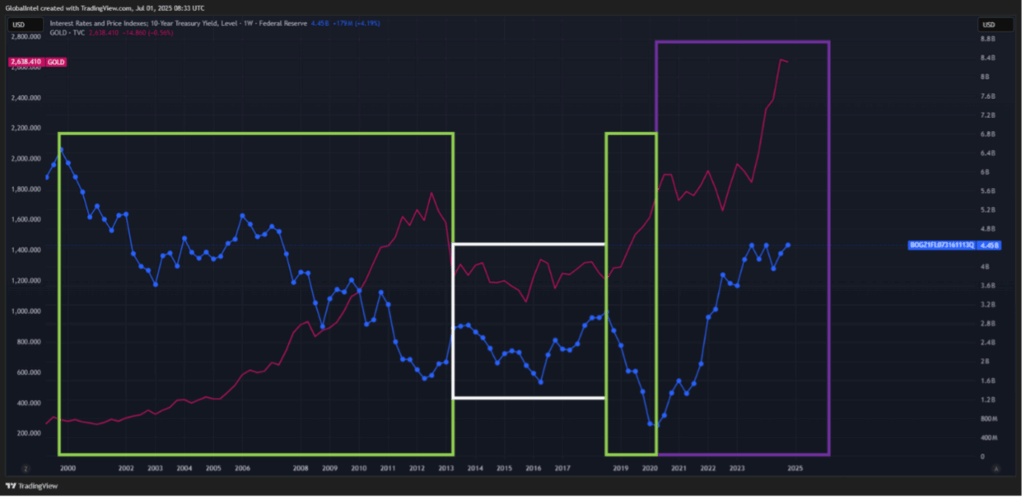

I know the numbers and data are hard to see (I’m pushing the techies to create a button you can click to see a full image). However, all you really need to know is this:

- The blue line is market-based interest rates on the US 10-year Treasury Note—the most important maturity of all US debt because it serves as the benchmark that helps set interest rates on everything from credit cards to mortgages to corporate debt.

- The red line is gold.

- The date axis starts in the year 2000 there on the left and runs through today.

The first and third boxes (both green) represent normalcy: Bond yields (blue) are generally falling; gold prices (red) are generally rising. That’s textbook—exactly what the markets would expect.

The middle box (white) is a no-man’s land. Bond yields and gold prices meandered through the middle part of last decade, guided by no meaningful forces. Both gold and 10-year Treasury yields pretty much ended up where they began.

And then we come to Abby Normal…

She has a very different personality. A worrywart mixed with overeager Boy Scout.

Abby Normal is the purple box there at the far right—a period that began late-June 2020, in the throes of the COVID pandemic, when America (and much of the world) started spitting out money like a PEZ dispenser that never runs out of candy.

Bond yields started rising fast. Gold prices should have been sinking fast. After all, that’s what the textbook says should happen.

But why, El Jefe my captain, does the textbook say that?

Because if investors can earn increasingly better yields by holding (theoretically) safer US debt, then gold is (theoretically) less appealing. It pays no interest, and it earns no profits that would fund a dividend. Gold’s income potential is as inert at the metal itself.

But Abby Normal shows up to say, “Hold my beer…”

As I noted, she’s a worrywart inside an overeager Boy Scout, meaning that she’s terrified about America’s financial future and, so, she’s preparing for the bad moon that’s rising by loading up on as much gold as she can.

And in doing so, she has turned the market topsy-turvy.

Bond yields in 2020 started to race higher on two fears:

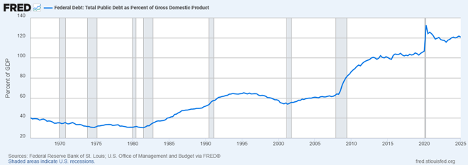

- America’s debt situation was increasingly problematic because of extremely fast growth in borrowing that now has US debt at a debilitating 120% of GDP. This chart from the Federal Reserve’s St. Louis branch tells that story. Look at the far right; that straight line up is 2020. And while debt to GDP has come down slightly, the quantity of debt keeps going up even as the economy grows. Debt that was $22.7 trillion in 2019 before COVID arrived is now $37 trillion today—a more than 37% increase in just six years… meaning America is demonstrably living on debt.

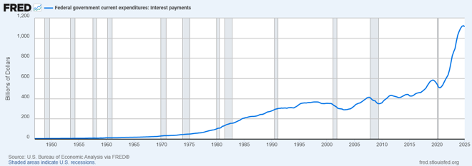

2. America’s debt-repayment situation—a result of all that extreme borrowing and those rising interest rates I showed you in the first graph we started with today—is pushing the boundaries of Uncle Sam’s financial capacity. The government is now spending 15% of its budget just on repaying debt. A huge number. Again, a St. Louis Fed chart…

That’s America’s annual interest payments on the debt. Again you see that post-COVID spike, when borrowing demands and interest rates were both flying higher. America is now well above $1 trillion in annual interest payments, the third largest expense behind Medicare/Medicaid and Social Security.

It even tops defense spending, which is saying something in a country that venerates guns and war more than it does schoolyard safety.

Thus, Abby Normal and her arrival…

Question is: How long will she stick around?

Well, you know that I expect a crisis before this decade is out.

And there is not a single hint anywhere in government that would suggest that the DC Clown Car has any thoughts on addressing the debt. Trump’s “Big Beautiful Bill” could add as much as $5 trillion to the debt.

So Abby Normal is going to stick around for a while.

Likely through the end of this decade and into the 2030s.

Basically, she’s here until a US debt crisis forces changes to the structure of America’s balance sheet… and to the dollar.

What I’m getting at here is this: You don’t have to listen to me about owning gold and reducing your exposure to the US dollar (though my track record has been pretty good with this topic). You absolutely should, however, listen to Abby Normal.

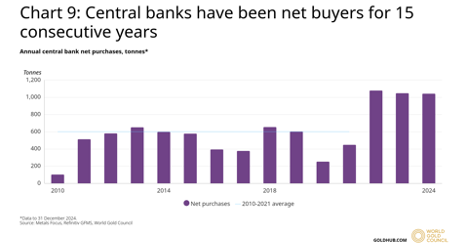

And you should listen to central banks around the world. To that end, I have one last chart for you, from a World Gold Council report back in February:

Central banks have been net buyers of gold for the last 15 years, in the wake of the Great Recession that showed just how fragile the global financial system really is. But again, look at 2020 (that short purple bar two past 2018). Gold demand among central bankers quickly ramped up to record levels and it hasn’t really fallen off.

There is a loud message in that.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.