On the morning of Sept. 11, 2001, I woke up to a flooded basement.

In the horrific context of that day, my morning chores of futzing with a faulty water heater and draining my basement just as I needed to prepare for another day at work were very trivial matters.

Only, they weren’t trivial to me in the slightest.

I was living in Boonton, New Jersey at the time.

A staff writer for The Wall Street Journal.

My office at the World Financial Center in Lower Manhattan was literally across West Side Highway from the World Trade Center.

Every morning, I hopped on a New Jersey Transit train and made my way to Hoboken, where I transferred to the PATH subway line for the short ride beneath the Hudson River and into the basement of the WTC.

On the morning of Sept. 11, 2001…that busted water heater very likely saved my life.

I was supposed to be in the WTC basement, as I was just above every other weekday morning, right about the time the planes struck.

But those moments I spent dealing with that water heater meant I missed my regular train from Boonton…which meant I missed my regular subway ride into Lower Manhattan…which means I am here today, 20-plus years later, to remind you that everything you know as normal can fundamentally change on the most banal of days.

The real point that I am now getting to fairly late in this dispatch is centered on the U.S. dollar.

This is not a screed about how the Federal Reserve has screwed up. It’s not to harp on why you should be buying gold.

Instead, it’s a story about change. About how things you’ve known as normal all your life, things that seem as permanent as granite cliffs, are really quite fragile.

My hope is that the story resonates with you on some level. That you spend the next few days or weeks replaying this story in your head, and that it leads you to pursue whatever financial changes you need to make in your life to prepare for the change that’s already blowing in the wind.

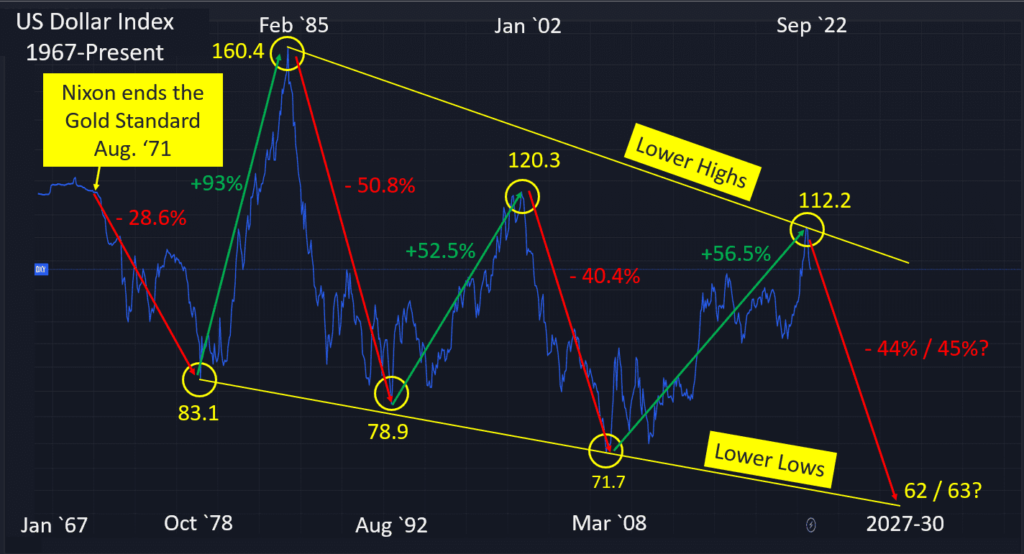

I want to start with this chart:

That is the U.S. Dollar Index, which tracks the greenback against a basket of global currencies. We start 55 years back, in 1967, to give you a long historical view of the dollar over a large sweep of time. I have annotated this to help you better recognize what’s going on.

- The dollar over this grand arc has been locked into a downward trend, with lower lows and lower highs. That’s a long-term bearish trend.

- Dollar trends—up and down—move across large blocks of time. For instance, the dollar fell nearly 29% over the seven-year stretch from August 1971, when Nixon took the dollar off the gold standard, until October 1978. The next dollar low occurred 14 years later…and the one after that required 16 years. (I don’t count anything prior to the gold standard moment, since the dollar was fundamentally different when it was fully backed by gold.)

- Upcycles are just as long. The span between the four-dollar peaks from 1971 and September 2022 are 14 years, 17 years, and 20 years, respectively.

I share this chart because it says a great deal about the long-term direction of the dollar.

And that direction is lower.

Sharply lower.

I say that because there is nothing fundamental to the dollar’s current strength. As I have noted numerous times, it is wholly a function of the Federal Reserve raising interest rates faster than other nations, which creates demand among traders to temporarily move into the higher-yielding currency to create an easy, near-risk-free profit.

Alas, it is but a sugar-high.

The market is already anticipating an end to the Fed’s rate hikes, which is why the dollar peaked last fall and is already in a downtrend. Traders are getting out in front of the Fed to position themselves for what’s to come—a weak dollar.

I see more than a weak dollar.

For a while now, I’ve been sharing with you my belief that a crisis is imminent later this decade.

What I really mean is a fundamental rethink of the current arrangement in which the U.S. dollar is the medium of global trade (85% of world trade is tied to the dollar, as is 60% of currency reserves held by global central banks).

A large part of the world is not happy with that arrangement (even friends of Uncle Sam quietly pan this setup because it means the U.S. exports inflation around the world, even as the U.S. government and Americans benefit mightily from lower prices on consumer goods and debt).

Beyond that, the dollar is a currency measured by America’s extreme levels of debt and, increasingly, D.C.’s willingness to use the dollar as a weapon to extract whatever action it wants from other governments.

The world is moving away from a dollar-centric view of the global economy. America, meanwhile, has a reckoning with debt that it must confront. The Fed’s actions over the last year have laid bare that reality.

The fact that so many thinkers realize the Fed is hamstrung—it cannot raise rates much higher without causing economic destruction—tells us Uncle Sam’s path forward:

- Permanently higher inflation rates, likely varying in the 4.5% to 7% range.

- Permanently slower economic growth, likely sub-2% as the decade progresses.

- Ever-increasing debts as Congress blithely spends and spends.

- A tipping point, where the cost of servicing all of America’s debts is too great, and a fiscal and monetary crisis erupts.

In the chart above, I have that occurring in the 2027 to 2030 timeframe, at which point the dollar index is down 45% or so from current levels.

But therein lies the good news: The bottom.

The crisis will be painful—exceedingly so. Great wealth will be lost. A Greater Depression.

But it will be cathartic as well. A new financial standard will emerge globally. Likely it will be tied to blockchain technology in some fashion, including a digital U.S. dollar and a new form of taxation.

Will it all play out exactly like that? Impossible to know.

But that chart above, and my experience on 9/11 says that life changes all the time when you least expect it.

What’s normal today is suddenly quaint tomorrow.

That’s why it’s prudent to diversity some of your wealth out of the dollar today.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.