Lately I’ve spotted a trend amongst the people who consult with me: They want to own gold… and they want to keep it abroad.

I’ll talk about storing gold in foreign vaults next week. But today I want to put on my economist hat and talk about why gold is on such a tear.

Knowing what makes gold’s price price go up and down is critical.

Historically, three levers drive the gold price:

- Fears of a loss of purchasing power, through inflation, currency decline, or both.

- The attractiveness of alternative assets like stocks and bonds, which is largely a factor of real interest rates.

- Fear of economic catastrophe.

Of the three, the most significant factor is interest rates. Federal Reserve Bank of Chicago analysts studied the gold price since 1971, when the US came off the gold standard. By far the largest impact on the yellow metal’s price was real interest rates.

Usually, when interest rates are low, stock prices rise, so people sell gold to free up money to invest in the stock market. By contrast, when interest rates are high, people don’t want to own gold because they can get good income from safe investments like Treasury bonds.

This is why gold’s performance since the end of 2021 if so puzzling. Its price has climbed even as yields on 10-year inflation-protected US Treasury bonds rose from -1% to around 1.8% now. The last time real yields were this high, gold was only worth about $1,000 an ounce, more than two thirds less than its current price.

On top of that, US stock market indices have risen considerably mid-2022—the one exception being a big dip in the first quarter of this year.

Why this departure from the norm? Let’s deal with the stock market issue first.

Since the late 1990s, the US stock market has seen waves of enthusiasm for technology stocks. Price bubbles include the dot-com boom, the telecoms infrastructure craze, the social media boom, the cloud computing craze, fintech, and then the COVID meme stock frenzy.

The latest wave is based on artificial intelligence. A mere seven AI-linked stock tickers have accounted for 75% of the S&P 500’s return over the last two years. The gap between a cap-weighted index of the S&P 500 and the equal weight version is the largest it has been for the last 15 years, indicating an extremely narrow market.

Big investors know what tends to follow these tech booms: a crash. They are already cashing in their gains from the AI boom and transferring the proceeds into safe hedges like gold. In other words, whilst less-savvy investors are poised to lose their shirts, the smart money is protecting itself, driving up the price of gold.

But that’s a relatively small influence on gold’s recent rise. The biggest factor is fear of economic catastrophe.

After the US delinked the dollar from gold in 1973, central banks around the world had little reason to hold a lot of gold. It made more sense for them to hold Treasury bonds, since their market was extremely liquid and they provided a cash yield. After falling from 40% in 1970 to just 6% in 2008, the percentage of gold held by central banks rose slowly, in response to the global financial crisis that started that year.

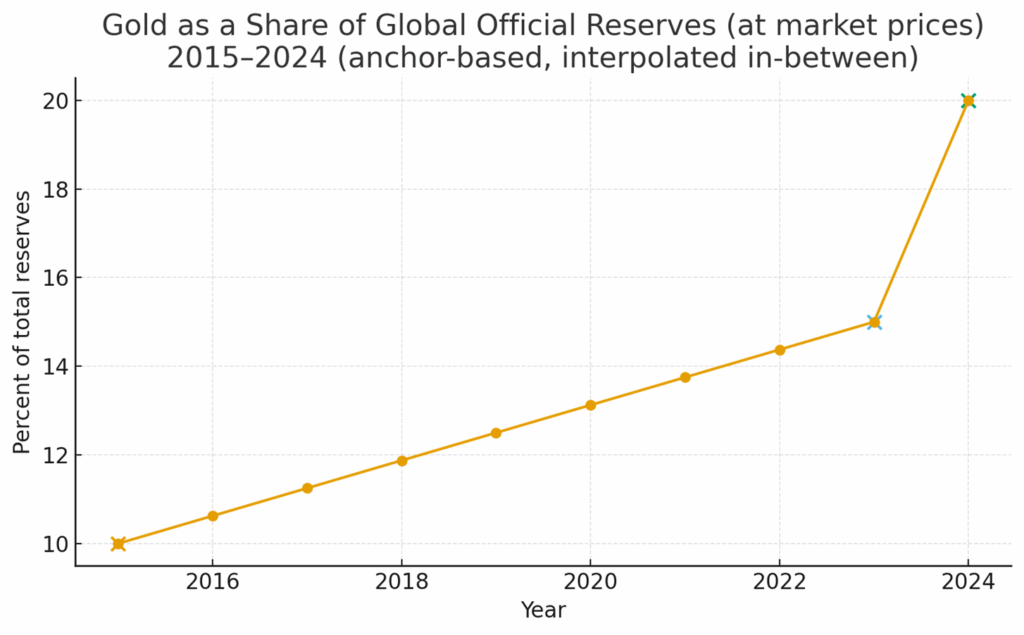

That pattern changed dramatically in mid-2023:

Since then, the proportion of gold reserves held by central banks has risen from 15% to 20%.

Several factors have contributed to this spike. One is US sanctions on Russia, which showed that Treasury bond holdings are extremely risky if America gets upset at you. That’s why countries like China have increased their gold holdings, to avoid Russia’s fate.

But central banks of countries friendly to the United States have also increased their holdings. Singapore has accumulated 75 tons of gold since the beginning of 2022. Poland has increased its holdings by 167 tons. A survey of central banks by Invesco Asset Management earlier this year found that none of the 51 central banks surveyed expect to cut their gold holdings in the next three years, whilst 37% expect to increase it.

More than anything else, these strategic gold purchases by central banks account for the surge in the price of gold.

On the one hand, central banks are worried about being overexposed to Treasury bonds, given Russia’s experience. But just as important is the rising US federal budget deficit, and threats to the Fed’s independence from the Trump administration. So even while Treasury yields have increased, the gold price has skyrocketed—a clear departure from the norm.

The second factor is more insidious and less predictable. As the US retreats from both global free trade and active protection of allies, central banks want gold to protect against potential economic and financial collapse. As Adam Lapinsky, president of the Polish Central bank says, the price of gold “tends to be high precisely at times when the central bank might need its ammunition most.”

In other words, the demand for ammunition against global catastrophe is what’s driving the gold price… and as the threads of the post-war global fabric are unravelled one by one, that demand will grow.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.