One of the Most Important Assets in Human History.

Today, I play the role of thief. But just remember that Robin Hood stole from the rich to benefit the poor.

Not that I am implying that any of my readers are poor. Or that I’m rich. My goal with today’s dispatch is simply sharing the wealth.

In this case, the wealth is information. And I am stealing the information from BlackRock, the world’s largest asset manager.

Back in August, BlackRock released a report that is suddenly popping up on my Twitter/X feed. The report:

Bitcoin: A Unique Diversifier

Why bitcoin’s appeal to investors lies in its detachment from traditional risk and return drivers

I could go through the report and share a lot of BlackRock commentary with you. But frankly, the commentary isn’t far removed from all that I regularly share with you about bitcoin specifically and crypto more generally.

Instead… I want to share some charts.

Visual cues are a great way to bring information into your brain. And some of these charts, even for me, are “ah ha!” moments because they really drive home the message that if you’re not invested in bitcoin, you’re missing out on one of the most important assets to ever emerge in the course of human history.

Yes—that is a monster of a statement… “ever to emerge in the course of human history.”

It sounds overly dramatic. A cheap sales pitch from a former used-car dealer.

But I truly believe bitcoin is going to change the world of fiat currency that you and I have known for the last half century. When fiat currencies run up on the shoals—and that moment is coming—the world is going to race into two primary assets: gold and bitcoin. (This, by the way, is precisely why central banks cumulatively now hold record amounts of gold. They fear what they know is on the way.)

As important as gold will be in repairing the damage to come, gold is not an easily traded asset in terms of buying milk and Twinkies at the Piggly Wiggly down the street. For that, we’re going to need an easily transportable, easily spendable form of currency where no one can monkey around with its value.

That’s bitcoin.

But onto those charts that I’m stealing from BlackRock… (Note: some of these charts look wonky. That’s because I had to steal them off Twitter, where a user posted slides from a recent BlackRock bitcoin presentation at a crypto conference.)

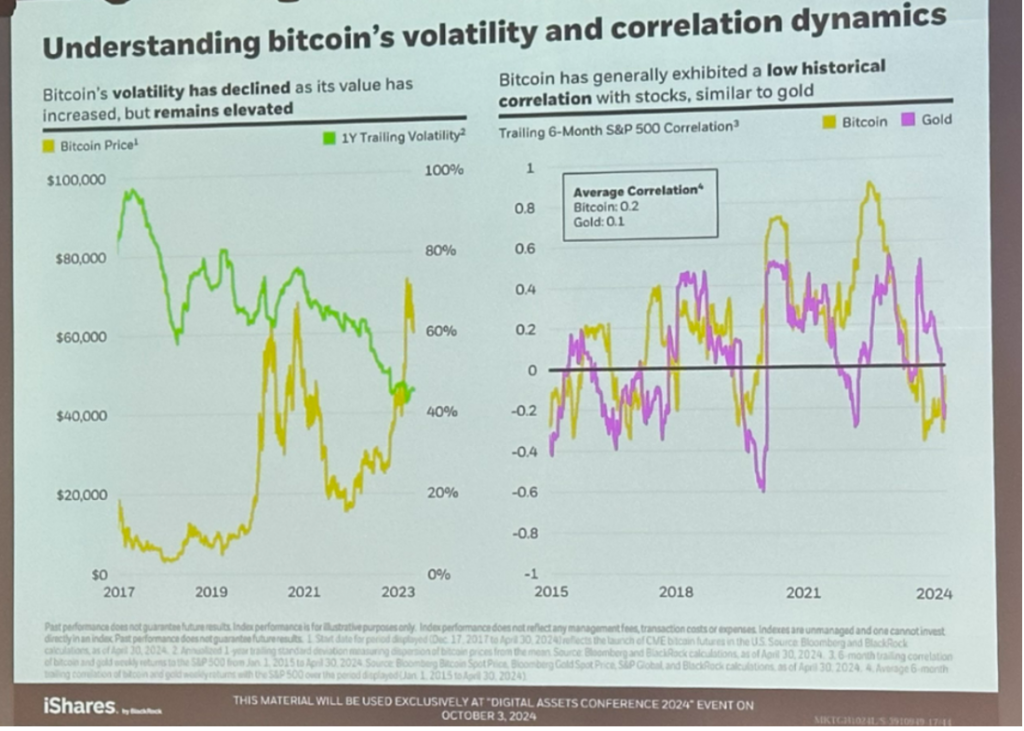

This is one of the wonky slides. On the left, it is showing one of the things that for the last couple of years I’ve been saying is coming: bitcoin is increasingly less volatile (green line).

Yes, it’s still volatile. But the volatility is declining. Why? Because more people own it and many own it through institutions, meaning they’re not quick to pull the trigger and flee on down days.

On the right-hand side of the chart, the pink and yellow lines represent gold and bitcoin respectively. And they’re very closely tracking one another. The message being that the world really does treat bitcoin like “digital gold.” It’s not so much a digital asset as it is an asset that has no ties or allegiance to any one country or economy.

It is pure financial freedom, just like gold. Thus, bitcoin generally follows gold.

Second chart…

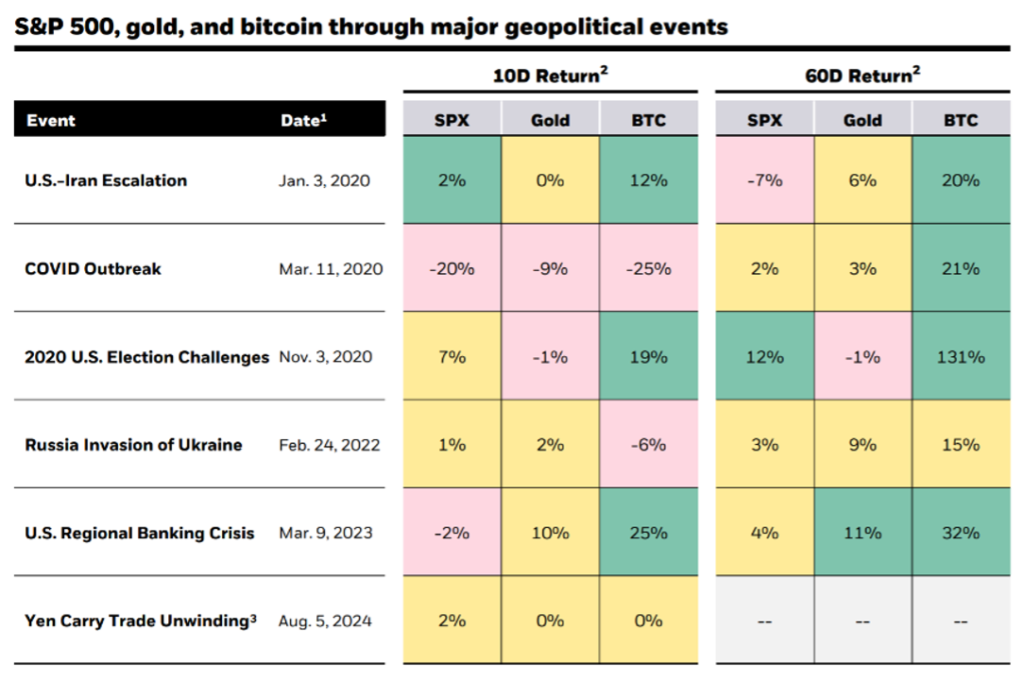

This is a fantastic representation of bitcoin’s reaction to significant geopolitical events.

Only the immediacy of the COVID outbreak and Russia’s invasion of Ukraine sent bitcoin temporarily lower. In all instances, bitcoin’s price was higher two months after the event.

The chart’s message, which I’ve been sharing for a long time to anyone who will listen: bitcoin is a safe-haven asset.

Again, I absolutely concede that bitcoin is hellaciously volatile as a safe-haven asset. But you roll with the volatility. You accept the fact that volatility is in bitcoin’s nature. And just like you overlook those niggling annoyances in your spouse, you overlook bitcoin’s psychotic short-term bursts of volatility because the long-term trend is what’s truly important here.

Stolen chart #3… my favorite of the trio.

This is kinda hard to read. Sorry about that. This is one I pilfered from Twitter/X and I cannot find the clean version online anywhere. So I will explain it, since the numbers are small.

On the far left, that’s what a typical investment portfolio looks like: 60% stocks, 40% bonds. On the right, a portfolio in which 3% of the assets are allocated to bitcoin.

The results:

- The traditional portfolio generates a return of 5.54% with volatility of 9.89%. The max drawdown, or how far the portfolio is expected to fall in the worst moment, is 21.3%.

- The bitcoin 3% portfolio generates a return of 8.42% with volatility of 10.69%. The max drawdown is 22.32%.

In short: this chart is underscoring the message I’ve been sending in my dispatches—that a small taste of bitcoin in your portfolio is a good thing, and that any financial professional who counsels against that is a financial professional you should immediately fire. They do not understand the most important asset of the 21st century, they refuse to learn, and they are doing you a vast disservice that will impede the growth of your wealth.

Personally, I go farther than 3%. I’ve noted in several Field Notes dispatches that I think a 5% position is fine for everyone. Literally everyone.

At the absolute worst, if bitcoin goes to $0 (it won’t), you lose the equivalent of about one year’s worth of dividends and interest payments that a balanced portfolio will typically give you.

At best, your 5% position is going to grow explosively and will be 60% or 90% or 115% of your portfolio on the day you originally invested. There is not an asset class in your portfolio right now that holds that kind of risk-reward imbalance.

You risk a very tiny portion of your portfolio in return for the possibility of outsized gains most people never even imagine are possible.

I’ll note that BlackRock actually shows what a 5% position looks like. I didn’t include it here because BlackRock is comparing it to Brazilian equities, since the presentation was delivered in Brazil. But just so you know, with a 5% position in bitcoin, a portfolio generates a return that is more than double a traditional portfolio, and the max drawdown is actually less.

Volatility is higher, but again I’ll stress that you simply must accept that bitcoin introduces crazy volatility into your life. If you cannot stomach the roller-coaster soaring and dipping, and you know that you’re going to bail the first time bitcoin dips hard, then I have to tell you to stay away from bitcoin. You’re going to miss out on the vast gains ahead, but more important, you’re going to miss out on the losses you will otherwise accumulate by fleeing bitcoin in a volatile moment.

So, those are my stolen charts.

I hope you see in them what I do: That bitcoin is emerging as exactly what it was supposed to be… a store-of-value asset that you buy and hold for the day the world’s fiat currency system comes tumbling down.

And that day is coming.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.